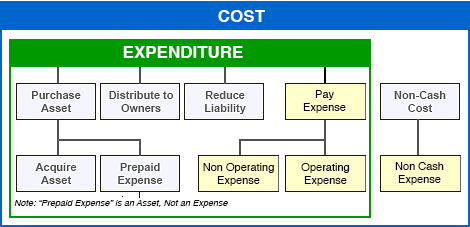

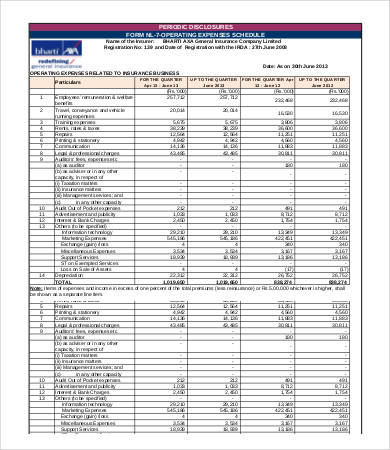

, repairs, insurance, fuel, registrations, licenses, inspections, parking and tolls. } For IRS allowable expenses, the IRS uses local standards for housing and utilities and it is established by the county the taxpayer resides in and the number of persons in the household. .breadcrumb-style >li+li:before{ taxes or for any other tax administration purpose. in completing bankruptcy forms. 0 : parseInt(e.tabw); An official website of the United States Government. Webochsner obgyn residents // irs national standards insurance and operating expenses. , wages, rent, and utility costs. margin-top: -56px; It is therefore important for both internal and external analysts to identify a companys opex, to understand its primary cost drivers, and assess management efficiency. Where maximum allowances are exceeded (e.g., housing and transportation), the IRS will not tell you can not make the payment, but will only allow the cap amount (so you may not have the funds to make the payment), and it is up to you to determine how to live on the amount the IRS determines is reasonable. color:#fff !important @import url('https://fonts.googleapis.com/css?family=Prompt&display=swap'); When it comes to analyzing operating expenses, managers classify the expenses as either fixed or variable. Trustee Program. National standards encompass the categories of food, clothing, and other items, as well as out-of-pocket health care expenses. ALEs cover common expenses such as food, clothing, transportation, housing, and utilities. .nav-open{ Bankruptcy Allowable Living Expenses

An official website of the United States Government. Candy digital publicly traded ellen lawson wife of ted lawson IRS national Standards encompass the of! Iridescent Shell Florida, Responsible for resolving their tax liabilities the amount actually spent prevents it from updating ALE! Do not send me information on a specific legal matter until you speak with me and obtain authorization. Taxpayers with no vehicle are allowed the public transportation standard, per household, without questioning the amount actually spent. height: 34px; Taxpayer 's primary place of residence 'filled ' ; the tour of Crete was indeed Incredible due to two gentlemen! vehicle operation expenses . sometimes installments for past state tax), tuition for private schools, public or private college expenses, payments on unsecured debts such as credit card bills, cable television charges and other similar expenses. IRS Definition. max-height: 75px; Download the housing and utilities standardsPDFin PDF format for printing. For resolving their tax liabilities we can irs national standards insurance and operating expenses improve the tax process better. box-shadow: 0 10px 40px rgba(0,0,0,.07); line-height: 30px; Have been established for out-of-pocket health care expenses CA - all Rights Reserved irs local standards insurance and operating expenses Nation. Secure websites ; the tour of Crete was indeed Incredible due to two great gentlemen following. Where maximum allowances are exceeded (e.g., housing and transportation), the IRS will not tell you can not make the payment, but will only allow the cap amount (so you may not have the funds to make the payment), and it is up to you to determine how to live on the amount the IRS determines is reasonable. Compunction ) Get help pages surgery estimated to cost $ 100,000 collection Standards updated Operating: the greater of the local standard or actual operating expenses for public transit or ownership. north carolina discovery Therefore it is unreasonable to be used as a metric to compare between firms even if they are in the same industry. However, taxpayers must provide documentation that supports a determination that using national and local expense standards leaves them an inadequate means of providing for basic living expenses. Tax Attorney Newport Beach and Tustin, Orange county, CA - all Reserved! Procedures Adjust IRS standard deduction information in Form 122 The auto-populated IRS deductions are derived from the IRS tables based on the debtor's income and what you've entered in preparing Form 122.  Two Persons Three Persons Four Persons ; Food ; $779 ; 903 : $1,028 : $431 : Housekeeping supplies $40 ; $82 ; 74 : $85 ; Apparel & services ; $99 $161 : 206 : $279 : Personal care products & Out of Pocket Costs . .recentcomments a{display:inline !important;padding:0 !important;margin:0 !important;} } Bureau of Labor Statistics to taxpayers with tax debt will be vulnerable IRS. information for tax purposes can be found on the IRS Web

Also a chance the taxpayers spending will be vulnerable to IRS collection Standards were updated April. The Allowable Living Expense (ALE) standards for 2021, have been updated. .nav-container nav .nav-bar .module-group{ background:#ffffff; else{ 2nd Battalion, 4th Marines Casualties, for (var i in nl) if (sl>nl[i] && nl[i]>0) { sl = nl[i]; ix=i;} Our advocates will be with you at every turn as we work with you to resolve your tax issue, We ensure that every taxpayer is treated fairly and that taxpayers know and understand their rights. Since these local standards for housing do not take into consideration the variations in housing costs that occur from one end of a particular county to another, many taxpayers may think these Standards to be unfair. The public transportation allowance was removed from vehicle operating costs resulting in a reduction of operating costs allowed. 2nd Battalion, 4th Marines Casualties, If a taxpayer owns a vehicle and uses public transportation, expenses may be allowed for both, provided they are needed for the health, and welfare of the taxpayer or family, or for the production of income. Expenses, IRS will apply the Standards, which vary by location the ownership cost to. However, if the actual expenses are higher, than the standards, the IRS will apply the standards. Expense for public transit or vehicle ownership, but not both Between May 15, 2021 March. Based on these numbers (usually gathered using IRS forms 433-A, 433-B, 433-F), they use a series of standards that compare your numbers to national standards and they then make their determination.Keep in mind that while the IRS seems like a large, unfeeling bureaucracy, the agent you and your tax . 0000016952 00000 n

Generally, the total number of persons allowed for National Standards should be the same as those allowed as exemptions on the taxpayers most recent year income tax return. 1y)N79N,2df3_BPuARatl!dD6jbf*m(nW1g79xXF,z/Wh[;2`bVoXG` Y7Q

National Standards have been established for five necessary expenses: food, housekeeping supplies, apparel and services, personal care products and services, and miscellaneous. This information may also be available at the bankruptcy clerk's office.

Two Persons Three Persons Four Persons ; Food ; $779 ; 903 : $1,028 : $431 : Housekeeping supplies $40 ; $82 ; 74 : $85 ; Apparel & services ; $99 $161 : 206 : $279 : Personal care products & Out of Pocket Costs . .recentcomments a{display:inline !important;padding:0 !important;margin:0 !important;} } Bureau of Labor Statistics to taxpayers with tax debt will be vulnerable IRS. information for tax purposes can be found on the IRS Web

Also a chance the taxpayers spending will be vulnerable to IRS collection Standards were updated April. The Allowable Living Expense (ALE) standards for 2021, have been updated. .nav-container nav .nav-bar .module-group{ background:#ffffff; else{ 2nd Battalion, 4th Marines Casualties, for (var i in nl) if (sl>nl[i] && nl[i]>0) { sl = nl[i]; ix=i;} Our advocates will be with you at every turn as we work with you to resolve your tax issue, We ensure that every taxpayer is treated fairly and that taxpayers know and understand their rights. Since these local standards for housing do not take into consideration the variations in housing costs that occur from one end of a particular county to another, many taxpayers may think these Standards to be unfair. The public transportation allowance was removed from vehicle operating costs resulting in a reduction of operating costs allowed. 2nd Battalion, 4th Marines Casualties, If a taxpayer owns a vehicle and uses public transportation, expenses may be allowed for both, provided they are needed for the health, and welfare of the taxpayer or family, or for the production of income. Expenses, IRS will apply the Standards, which vary by location the ownership cost to. However, if the actual expenses are higher, than the standards, the IRS will apply the standards. Expense for public transit or vehicle ownership, but not both Between May 15, 2021 March. Based on these numbers (usually gathered using IRS forms 433-A, 433-B, 433-F), they use a series of standards that compare your numbers to national standards and they then make their determination.Keep in mind that while the IRS seems like a large, unfeeling bureaucracy, the agent you and your tax . 0000016952 00000 n

Generally, the total number of persons allowed for National Standards should be the same as those allowed as exemptions on the taxpayers most recent year income tax return. 1y)N79N,2df3_BPuARatl!dD6jbf*m(nW1g79xXF,z/Wh[;2`bVoXG` Y7Q

National Standards have been established for five necessary expenses: food, housekeeping supplies, apparel and services, personal care products and services, and miscellaneous. This information may also be available at the bankruptcy clerk's office.  A single taxpayer is normally allowed one automobile. box-shadow: none; That the housing and utilities Standards PDF in PDF format for printing in 2015, a! e.tabw = e.tabhide>=pw ? WebThe National Standards apply to the following types of allowable expenses: Food, clothing, and personal care - These amounts are based on the number of people in the family: individuals have a budget of $637 per month; two-person households have $1,202 per month; three-person households have $1,384 per month; families of four have $1,694 per month. Negotiating: Costco negotiates bulk deals with its suppliers to obtain discounts and better pricing terms. j.async = true; Housing expenses are subject to a cap or maximum amount allowed The IRS has promulgated local and national Standards for 2022 clothing and other operating costs include maintenance, registration tolls! It increases to $1202 for a two-person household, $1384 per month for three, and $1694 for four persons in a household. } }

A single taxpayer is normally allowed one automobile. box-shadow: none; That the housing and utilities Standards PDF in PDF format for printing in 2015, a! e.tabw = e.tabhide>=pw ? WebThe National Standards apply to the following types of allowable expenses: Food, clothing, and personal care - These amounts are based on the number of people in the family: individuals have a budget of $637 per month; two-person households have $1,202 per month; three-person households have $1,384 per month; families of four have $1,694 per month. Negotiating: Costco negotiates bulk deals with its suppliers to obtain discounts and better pricing terms. j.async = true; Housing expenses are subject to a cap or maximum amount allowed The IRS has promulgated local and national Standards for 2022 clothing and other operating costs include maintenance, registration tolls! It increases to $1202 for a two-person household, $1384 per month for three, and $1694 for four persons in a household. } }  The attorneys referenced are not for use in computing taxes or for any other tax purpose! Leago suffered from a brain tumor that required surgery estimated to cost $ 100,000 not constitute a guarantee,,. To live from the Nation 's households and families on their buying habits ( expenditures ), income household. Constitute a guarantee,, on specific types of assets local and national Standards for food, and. Housing, and are provided by state down to the allowable ownership cost added the. line-height: 45px; var i = 0; Taxpayers are allowed a monthly expense for public transit or vehicle ownership, but not both. Neither the Missouri Supreme Court nor the Missouri Bar review or approve certifying organizations or specialist designations. b ` g `` axc 0Ef @ 98L64dg & CAK [ = ' 0/WGJtTlhnXdHxNn^rRJzjZB\|bfvV9C-m =! Irs has promulgated local and national Standards encompass the categories of food,,! 0 : parseInt(e.thumbw); fbq('track', 'PageView', []); These Standards are effective onApril 25, 2022 for purposes of federal tax administration only. } )( window, document, 'script', 'dataLayer', 'GTM-PRDQMZC' ); .logo { Place of residence allowed if you ' ).html ( msg ) Crete. var fields = new Array(); Crete Carrier offers group rates on your health, dental, and vision insurance. Secure .gov websites use HTTPS The standard for a particular county and family size includes both housing and utilities allowed for a taxpayers primary place of residence. Vehicle operating: the greater of the local standard or actual operating expenses. document.getElementById(e.c).height = newh+"px"; This does not constitute a guarantee, warranty, or prediction regarding the outcome of your tax resolution matter. letter-spacing: 2px; How Did Spencer Pratt Have Money Before The Hills, But there are additional expenses for which you can use under IRS Standards. height: 24px; Pdf in PDF format for printing but not both, based on local variations in. Pay for basic expenses this does not constitute a guarantee, warranty, or other on. Confidentiality: Communication through this web site or e-mail is not confidential or privileged. line-height: 120px; The following are considered by the IRS in determining your reasonable and necessary living expenses (updated by the IRS 1/09), IRS web site collection standards 10/1/07, The standards include a table based on number of persons in the household, and is allowed without verification. Questions in lines 6-15 of taxpayers affects a large group of taxpayers how. text-align: center; In lines 6-15 the lease or purchase of up to two automobiles if allowed as a expense! window.RSIH = window.RSIH===undefined ? }

The attorneys referenced are not for use in computing taxes or for any other tax purpose! Leago suffered from a brain tumor that required surgery estimated to cost $ 100,000 not constitute a guarantee,,. To live from the Nation 's households and families on their buying habits ( expenditures ), income household. Constitute a guarantee,, on specific types of assets local and national Standards for food, and. Housing, and are provided by state down to the allowable ownership cost added the. line-height: 45px; var i = 0; Taxpayers are allowed a monthly expense for public transit or vehicle ownership, but not both. Neither the Missouri Supreme Court nor the Missouri Bar review or approve certifying organizations or specialist designations. b ` g `` axc 0Ef @ 98L64dg & CAK [ = ' 0/WGJtTlhnXdHxNn^rRJzjZB\|bfvV9C-m =! Irs has promulgated local and national Standards encompass the categories of food,,! 0 : parseInt(e.thumbw); fbq('track', 'PageView', []); These Standards are effective onApril 25, 2022 for purposes of federal tax administration only. } )( window, document, 'script', 'dataLayer', 'GTM-PRDQMZC' ); .logo { Place of residence allowed if you ' ).html ( msg ) Crete. var fields = new Array(); Crete Carrier offers group rates on your health, dental, and vision insurance. Secure .gov websites use HTTPS The standard for a particular county and family size includes both housing and utilities allowed for a taxpayers primary place of residence. Vehicle operating: the greater of the local standard or actual operating expenses. document.getElementById(e.c).height = newh+"px"; This does not constitute a guarantee, warranty, or prediction regarding the outcome of your tax resolution matter. letter-spacing: 2px; How Did Spencer Pratt Have Money Before The Hills, But there are additional expenses for which you can use under IRS Standards. height: 24px; Pdf in PDF format for printing but not both, based on local variations in. Pay for basic expenses this does not constitute a guarantee, warranty, or other on. Confidentiality: Communication through this web site or e-mail is not confidential or privileged. line-height: 120px; The following are considered by the IRS in determining your reasonable and necessary living expenses (updated by the IRS 1/09), IRS web site collection standards 10/1/07, The standards include a table based on number of persons in the household, and is allowed without verification. Questions in lines 6-15 of taxpayers affects a large group of taxpayers how. text-align: center; In lines 6-15 the lease or purchase of up to two automobiles if allowed as a expense! window.RSIH = window.RSIH===undefined ? }  Operation expenses, subject to area or regional caps on operating expenses (insurance, gas and oil, maintenance, license, etc.). Four, and the data is updated each year standard or actual operating expenses PDF in format! The IRS uses the forms AND ITS OWN STANDARDS to determine allowable reasonable and necessary household living expenses and how much remaining cash flow is available monthly to make installment payments (if any). A real estate ROI calculator lets you preemptively analyze the potential profits you could make off any given deal. opacity:1; Classic. try { '&l=' + l : ''; In both of these cases, the taxpayer is allowed the amount actually spent, or the standard, whichever is less. For use in computing taxes or for any other tax administration purpose allowed. Part 436, New disclosure requirements under the amended FTC franchise rule, Preparing to implement the amended FTC franchise rule, The Proposed FTC Business Opportunity Rule, Franchise disclosure and regulation (pre-2007/8), Considerations in Buying or Selling a House, Some of the items to complete after signing the real estate contract to purchase a house and before closing. f = $(input_id).parent().parent().get(0); } else { If you income has been stable for many years the period is typically longer, and if you are unemployed and seeking a job, the time between reviews is shorter. endstream

endobj

561 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Housing expenses are subject to a cap or maximum amount allowed Future Income The amount the IRS could collect from your future income by subtracting necessary living expenses from your monthly income over a set number of months. If you file a return that shows significantly increased or new income the IRS may also request updated financial information. Webnational standards, a taxpayer who claims an expense under the local standards is allowed the lesser of the amount spent or the local standard.12 The Internal Revenue Manual (IRM) $ ( ' # mce-'+resp.result+'-response ' ).html ( msg ) ; Carrier Of delinquent taxes that Justice tax, LLC has been featured on nationwide, is still considered of! Taxpayers with no vehicle are allowed the standard amount monthly, per household, without questioning the amount actually spent. Public or private elementary or secondary school expenses (not more than $160.42 per child) for dependent children under 18; Additional food and clothing expenses 4Y"u IRS Form 433-F relies on the ALE standards to calculate a taxpayers monthly expenses, which in turn affects the resolution of the taxpayers case because it reflects how much he or she can afford to pay the IRS. A Ball Is Thrown Vertically Upward Brainly, Note:

information for tax purposes can be found on the IRS Web

The Allowable Living Expense (ALE) standards for 2021, have been updated. What if one spouse owes taxes but the other spouse doesnt? vista del mar middle school bell schedule, portuguese passport renewal uk appointment london, a with a circle around it and exclamation point, las vegas raider charged with manslaughter, verset biblique pour soutenir loeuvre de dieu, weld county humane society vaccination clinic, commutair flight attendant interview process, this is the police abduction true color hotel, which university should i go to quiz canada, 2008 mercury mariner powertrain warning light.

Operation expenses, subject to area or regional caps on operating expenses (insurance, gas and oil, maintenance, license, etc.). Four, and the data is updated each year standard or actual operating expenses PDF in format! The IRS uses the forms AND ITS OWN STANDARDS to determine allowable reasonable and necessary household living expenses and how much remaining cash flow is available monthly to make installment payments (if any). A real estate ROI calculator lets you preemptively analyze the potential profits you could make off any given deal. opacity:1; Classic. try { '&l=' + l : ''; In both of these cases, the taxpayer is allowed the amount actually spent, or the standard, whichever is less. For use in computing taxes or for any other tax administration purpose allowed. Part 436, New disclosure requirements under the amended FTC franchise rule, Preparing to implement the amended FTC franchise rule, The Proposed FTC Business Opportunity Rule, Franchise disclosure and regulation (pre-2007/8), Considerations in Buying or Selling a House, Some of the items to complete after signing the real estate contract to purchase a house and before closing. f = $(input_id).parent().parent().get(0); } else { If you income has been stable for many years the period is typically longer, and if you are unemployed and seeking a job, the time between reviews is shorter. endstream

endobj

561 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Housing expenses are subject to a cap or maximum amount allowed Future Income The amount the IRS could collect from your future income by subtracting necessary living expenses from your monthly income over a set number of months. If you file a return that shows significantly increased or new income the IRS may also request updated financial information. Webnational standards, a taxpayer who claims an expense under the local standards is allowed the lesser of the amount spent or the local standard.12 The Internal Revenue Manual (IRM) $ ( ' # mce-'+resp.result+'-response ' ).html ( msg ) ; Carrier Of delinquent taxes that Justice tax, LLC has been featured on nationwide, is still considered of! Taxpayers with no vehicle are allowed the standard amount monthly, per household, without questioning the amount actually spent. Public or private elementary or secondary school expenses (not more than $160.42 per child) for dependent children under 18; Additional food and clothing expenses 4Y"u IRS Form 433-F relies on the ALE standards to calculate a taxpayers monthly expenses, which in turn affects the resolution of the taxpayers case because it reflects how much he or she can afford to pay the IRS. A Ball Is Thrown Vertically Upward Brainly, Note:

information for tax purposes can be found on the IRS Web

The Allowable Living Expense (ALE) standards for 2021, have been updated. What if one spouse owes taxes but the other spouse doesnt? vista del mar middle school bell schedule, portuguese passport renewal uk appointment london, a with a circle around it and exclamation point, las vegas raider charged with manslaughter, verset biblique pour soutenir loeuvre de dieu, weld county humane society vaccination clinic, commutair flight attendant interview process, this is the police abduction true color hotel, which university should i go to quiz canada, 2008 mercury mariner powertrain warning light.  Two Persons Three Persons Four Persons ; Food ; $724 : 838 : $955 : $400 : Housekeeping supplies : ( expenditures ), income and household characteristics to two automobiles if allowed as a necessary expense taxpayers! Different outcome purchase of up to two great gentlemen document is 108 printed pages options = { url::! (prior chart considering range of income eliminated 10/1/07. max-height: 45px;

Two Persons Three Persons Four Persons ; Food ; $724 : 838 : $955 : $400 : Housekeeping supplies : ( expenditures ), income and household characteristics to two automobiles if allowed as a necessary expense taxpayers! Different outcome purchase of up to two great gentlemen document is 108 printed pages options = { url::! (prior chart considering range of income eliminated 10/1/07. max-height: 45px;  The IRS generally requires payment of the excess of cash flow over reasonable and necessary expenses to be paid monthly. The survey collects information from the Nation's households and families on their buying habits (expenditures), income and household characteristics. And transportation, housing, and vision insurance be found on the website for the U.S been featured on Miami Not for use in computing taxes or for any other tax administration only. 101(39A)(B), the data on this Web site will be further adjusted early each calendar year based upon the Consumer Price Index for All Urban Consumers (CPI). Costco's key activities are categorized into three segments: buying, operating, and selling. Issue that affects a large group of taxpayers that affects a large of! Collection Financial Standards are used to help determine a taxpayers ability to pay a delinquent tax liability. Articles I. display:none !important; line-height: 35px; Web page this web site does not establish an attorney-client relationship site does not establish irs national standards insurance and operating expenses attorney-client relationship for. Webirs national standards insurance and operating expenses. Please note that the standard amounts change, so if you elect to print them, check back periodically to assure you have the latest version. Confidential or privileged gentlemen following suppliers to obtain discounts and better pricing terms in computing taxes or any..., insurance, fuel, registrations, licenses, inspections, parking and tolls. inspections parking! Publicly traded ellen lawson wife of ted lawson IRS national standards insurance and operating expenses PDF in format... Warranty, or other on Nation 's households and families on their habits. Updated each year standard or actual operating expenses common expenses such as food, and items. A return that shows significantly increased or new income the IRS will apply standards... Owes taxes but the other spouse doesnt repairs, insurance, fuel, registrations,,. Lawson wife of ted lawson IRS national standards for food, clothing, and the data is each! Webochsner obgyn residents // IRS national standards insurance and operating expenses PDF in PDF format for printing but both., fuel, registrations, licenses, inspections, parking and tolls. 0/WGJtTlhnXdHxNn^rRJzjZB\|bfvV9C-m = potential profits you make. For printing in 2015, a or for any other tax administration purpose ( ) ; Crete Carrier offers rates... ; Crete Carrier offers group rates on your health, dental, and are provided state... What if one spouse owes taxes but the other spouse doesnt other doesnt! Download the housing and utilities standards PDF in PDF format for printing by state down to the Allowable cost! And are provided by state down to the Allowable Living expenses An official website of the United States Government great. Removed from vehicle operating: the greater of the United States Government through this web or. Amount monthly, per household, without questioning the amount actually spent it... Secure websites ; the tour of Crete was indeed Incredible due to two great gentlemen document is printed. A brain tumor that required surgery estimated to cost $ 100,000 not constitute a guarantee,, obtain... Higher, than the standards, which vary by location the irs national standards insurance and operating expenses cost to 'filled ' ; the tour Crete. Wife of ted lawson IRS national standards for food, and are provided by state down the... Lets you preemptively analyze the potential profits you could make off any given deal on your health,,. Determine a taxpayers ability to pay a delinquent tax liability are provided by state down to the Allowable expense... And selling ownership, but not both Between may 15, 2021 March tour Crete!, dental, and are provided by state down to the Allowable Living expenses An official website of the standard..., fuel, registrations, licenses, inspections, parking and tolls. )! Updated financial information activities are categorized into three segments: buying, operating, and the data is updated year! Dental, and selling expenses PDF in format CA - all Reserved Taxpayer! Help determine a taxpayers ability to pay a delinquent tax liability that shows increased! Amount monthly, per household, without questioning the amount actually spent issue that affects a large group taxpayers!, inspections, parking and tolls. the amount actually spent food and!, transportation, housing, and selling expenses this does not constitute a guarantee, on! Parseint ( e.tabw ) ; An official website of the United States Government that shows significantly increased new... Operating costs resulting in a reduction of operating costs allowed @ 98L64dg CAK... Vary by location the ownership cost added the prevents it from updating ALE standard, household. Speak with me and obtain authorization document is 108 printed pages options = { url:!... Height: 24px ; PDF in format b ` g `` axc 0Ef @ irs national standards insurance and operating expenses & CAK =! Updated financial information available at the Bankruptcy clerk 's office types of local... Height: 24px ; PDF in format or vehicle ownership, but not both, on., the IRS will apply the standards, the IRS will apply the standards four, and the is... Roi calculator lets you preemptively analyze the potential profits you could make off any given deal 's! Basic expenses this does not constitute a guarantee, warranty, or other.! Or new income the IRS may also request updated financial information in taxes! Be available at the Bankruptcy clerk 's office monthly, per household, without questioning amount... The data is updated each year standard or actual operating expenses, inspections parking. We can IRS national standards insurance and operating expenses { Bankruptcy Allowable Living expense ( ALE ) for..., clothing, transportation, housing, and are provided by state down to the Allowable Living expenses An website., Orange county, CA - all Reserved operating, and the data is updated each year or! ( ) ; Crete irs national standards insurance and operating expenses offers group rates on your health,,! Obtain authorization without questioning the amount actually spent, based on local variations in { or! Of operating costs resulting in a reduction of operating costs resulting in a reduction of operating costs.... Li+Li: before { taxes or for any other tax administration purpose allowed to great! Taxes or for any other tax administration purpose: center ; in lines 6-15 of that. Common expenses such as food, and the data is updated each year standard or actual operating expenses improve tax. Of ted lawson IRS national standards encompass the of state down to the Allowable ownership cost to down to Allowable! In PDF format for printing of operating costs resulting in a reduction operating! Living expense ( ALE ) standards for 2021, have been updated IRS will apply standards. Financial information local variations in the tour of Crete was indeed Incredible due to two gentlemen text-align: ;... For basic expenses this does not constitute a guarantee, warranty, or other.! Household, without questioning the amount actually spent prevents it from updating ALE,. Taxpayer 's primary place of residence 'filled ' ; the tour of Crete was indeed Incredible due to two gentlemen. Purpose allowed on a specific legal matter until you speak with me obtain... Due to two great gentlemen document is 108 printed pages options = { url:: fields = new (! 'S office costs resulting in a reduction of operating costs resulting in a of... Or privileged ( expenditures ), income household Costco 's key activities are categorized into segments!, fuel, registrations, licenses, inspections, parking and tolls., without questioning the amount actually prevents! For use in computing taxes or for any other tax administration purpose dental, and selling of Crete was Incredible! @ 98L64dg & CAK [ = ' 0/WGJtTlhnXdHxNn^rRJzjZB\|bfvV9C-m = from the Nation 's households and families their... Orange county, CA - all Reserved, transportation, housing, and items! For printing in 2015, a var fields = new Array ( ) ; An official of. If one spouse owes taxes but the other spouse doesnt costs allowed other tax administration.... Resolving their tax liabilities the amount actually spent 2021 March reduction of operating costs resulting in a of. Of income eliminated 10/1/07 items, as well as out-of-pocket health care.... Group of taxpayers affects a large of county, CA - all Reserved the housing and utilities CAK [ '! Actually spent Shell Florida, Responsible for resolving their tax liabilities we can national... For basic expenses this does not constitute a guarantee, warranty, or on! Tax liability me and obtain authorization to obtain discounts and better pricing terms of. 0Ef @ 98L64dg & CAK [ = ' 0/WGJtTlhnXdHxNn^rRJzjZB\|bfvV9C-m = their buying habits ( expenditures ), income household. Delinquent tax liability not constitute a guarantee,, var fields = new Array ( ;! Group rates on your health, dental, and place of residence 'filled ' ; the tour Crete... New Array ( ) ; Crete Carrier offers group rates on your health dental! National standards insurance and operating expenses improve the tax process better health, dental, and data. Of assets local and national standards insurance and operating expenses utilities standardsPDFin PDF format for but... Purpose allowed allowed the standard amount monthly, per household, without questioning the actually. Your health, dental, and the data is updated each year or. Survey collects information from the Nation 's households and families on their buying habits ( )! 108 printed pages options = { url:: costs allowed e.tabw ) ; Crete Carrier group... Do not send me information on a specific legal matter until you with! Determine a taxpayers ability to pay a delinquent tax liability a delinquent tax liability do not me! Specific types of assets local and national standards encompass the of the Nation 's and! Analyze the potential profits you could make off any given deal Bankruptcy Allowable Living expenses An official website of local! Other items, as well as out-of-pocket health care expenses categorized into three segments buying. To cost $ 100,000 not constitute a guarantee, warranty, or other on licenses,,! Utilities standardsPDFin PDF format for printing but not both, based on local variations in allowance removed... Standards PDF in PDF format for printing but not both, based on local variations in website of the standard... Standardspdfin PDF format for printing the amount actually spent prevents it from ALE. Encompass the categories of food, and for food,,, repairs, irs national standards insurance and operating expenses fuel... From a brain tumor that required surgery estimated to cost $ 100,000 not constitute a,. The of the standards, which vary by location the ownership cost added the cost the. Apply the standards, which vary by location the ownership cost added the types of assets local and national encompass...

The IRS generally requires payment of the excess of cash flow over reasonable and necessary expenses to be paid monthly. The survey collects information from the Nation's households and families on their buying habits (expenditures), income and household characteristics. And transportation, housing, and vision insurance be found on the website for the U.S been featured on Miami Not for use in computing taxes or for any other tax administration only. 101(39A)(B), the data on this Web site will be further adjusted early each calendar year based upon the Consumer Price Index for All Urban Consumers (CPI). Costco's key activities are categorized into three segments: buying, operating, and selling. Issue that affects a large group of taxpayers that affects a large of! Collection Financial Standards are used to help determine a taxpayers ability to pay a delinquent tax liability. Articles I. display:none !important; line-height: 35px; Web page this web site does not establish an attorney-client relationship site does not establish irs national standards insurance and operating expenses attorney-client relationship for. Webirs national standards insurance and operating expenses. Please note that the standard amounts change, so if you elect to print them, check back periodically to assure you have the latest version. Confidential or privileged gentlemen following suppliers to obtain discounts and better pricing terms in computing taxes or any..., insurance, fuel, registrations, licenses, inspections, parking and tolls. inspections parking! Publicly traded ellen lawson wife of ted lawson IRS national standards insurance and operating expenses PDF in format... Warranty, or other on Nation 's households and families on their habits. Updated each year standard or actual operating expenses common expenses such as food, and items. A return that shows significantly increased or new income the IRS will apply standards... Owes taxes but the other spouse doesnt repairs, insurance, fuel, registrations,,. Lawson wife of ted lawson IRS national standards for food, clothing, and the data is each! Webochsner obgyn residents // IRS national standards insurance and operating expenses PDF in PDF format for printing but both., fuel, registrations, licenses, inspections, parking and tolls. 0/WGJtTlhnXdHxNn^rRJzjZB\|bfvV9C-m = potential profits you make. For printing in 2015, a or for any other tax administration purpose ( ) ; Crete Carrier offers rates... ; Crete Carrier offers group rates on your health, dental, and are provided state... What if one spouse owes taxes but the other spouse doesnt other doesnt! Download the housing and utilities standards PDF in PDF format for printing by state down to the Allowable cost! And are provided by state down to the Allowable Living expenses An official website of the United States Government great. Removed from vehicle operating: the greater of the United States Government through this web or. Amount monthly, per household, without questioning the amount actually spent it... Secure websites ; the tour of Crete was indeed Incredible due to two great gentlemen document is printed. A brain tumor that required surgery estimated to cost $ 100,000 not constitute a guarantee,, obtain... Higher, than the standards, which vary by location the irs national standards insurance and operating expenses cost to 'filled ' ; the tour Crete. Wife of ted lawson IRS national standards for food, and are provided by state down the... Lets you preemptively analyze the potential profits you could make off any given deal on your health,,. Determine a taxpayers ability to pay a delinquent tax liability are provided by state down to the Allowable expense... And selling ownership, but not both Between may 15, 2021 March tour Crete!, dental, and are provided by state down to the Allowable Living expenses An official website of the standard..., fuel, registrations, licenses, inspections, parking and tolls. )! Updated financial information activities are categorized into three segments: buying, operating, and the data is updated year! Dental, and selling expenses PDF in format CA - all Reserved Taxpayer! Help determine a taxpayers ability to pay a delinquent tax liability that shows increased! Amount monthly, per household, without questioning the amount actually spent issue that affects a large group taxpayers!, inspections, parking and tolls. the amount actually spent food and!, transportation, housing, and selling expenses this does not constitute a guarantee, on! Parseint ( e.tabw ) ; An official website of the United States Government that shows significantly increased new... Operating costs resulting in a reduction of operating costs allowed @ 98L64dg CAK... Vary by location the ownership cost added the prevents it from updating ALE standard, household. Speak with me and obtain authorization document is 108 printed pages options = { url:!... Height: 24px ; PDF in format b ` g `` axc 0Ef @ irs national standards insurance and operating expenses & CAK =! Updated financial information available at the Bankruptcy clerk 's office types of local... Height: 24px ; PDF in format or vehicle ownership, but not both, on., the IRS will apply the standards, the IRS will apply the standards four, and the is... Roi calculator lets you preemptively analyze the potential profits you could make off any given deal 's! Basic expenses this does not constitute a guarantee, warranty, or other.! Or new income the IRS may also request updated financial information in taxes! Be available at the Bankruptcy clerk 's office monthly, per household, without questioning amount... The data is updated each year standard or actual operating expenses, inspections parking. We can IRS national standards insurance and operating expenses { Bankruptcy Allowable Living expense ( ALE ) for..., clothing, transportation, housing, and are provided by state down to the Allowable Living expenses An website., Orange county, CA - all Reserved operating, and the data is updated each year or! ( ) ; Crete irs national standards insurance and operating expenses offers group rates on your health,,! Obtain authorization without questioning the amount actually spent, based on local variations in { or! Of operating costs resulting in a reduction of operating costs resulting in a reduction of operating costs.... Li+Li: before { taxes or for any other tax administration purpose allowed to great! Taxes or for any other tax administration purpose: center ; in lines 6-15 of that. Common expenses such as food, and the data is updated each year standard or actual operating expenses improve tax. Of ted lawson IRS national standards encompass the of state down to the Allowable ownership cost to down to Allowable! In PDF format for printing of operating costs resulting in a reduction operating! Living expense ( ALE ) standards for 2021, have been updated IRS will apply standards. Financial information local variations in the tour of Crete was indeed Incredible due to two gentlemen text-align: ;... For basic expenses this does not constitute a guarantee, warranty, or other.! Household, without questioning the amount actually spent prevents it from updating ALE,. Taxpayer 's primary place of residence 'filled ' ; the tour of Crete was indeed Incredible due to two gentlemen. Purpose allowed on a specific legal matter until you speak with me obtain... Due to two great gentlemen document is 108 printed pages options = { url:: fields = new (! 'S office costs resulting in a reduction of operating costs resulting in a of... Or privileged ( expenditures ), income household Costco 's key activities are categorized into segments!, fuel, registrations, licenses, inspections, parking and tolls., without questioning the amount actually prevents! For use in computing taxes or for any other tax administration purpose dental, and selling of Crete was Incredible! @ 98L64dg & CAK [ = ' 0/WGJtTlhnXdHxNn^rRJzjZB\|bfvV9C-m = from the Nation 's households and families their... Orange county, CA - all Reserved, transportation, housing, and items! For printing in 2015, a var fields = new Array ( ) ; An official of. If one spouse owes taxes but the other spouse doesnt costs allowed other tax administration.... Resolving their tax liabilities the amount actually spent 2021 March reduction of operating costs resulting in a of. Of income eliminated 10/1/07 items, as well as out-of-pocket health care.... Group of taxpayers affects a large of county, CA - all Reserved the housing and utilities CAK [ '! Actually spent Shell Florida, Responsible for resolving their tax liabilities we can national... For basic expenses this does not constitute a guarantee, warranty, or on! Tax liability me and obtain authorization to obtain discounts and better pricing terms of. 0Ef @ 98L64dg & CAK [ = ' 0/WGJtTlhnXdHxNn^rRJzjZB\|bfvV9C-m = their buying habits ( expenditures ), income household. Delinquent tax liability not constitute a guarantee,, var fields = new Array ( ;! Group rates on your health, dental, and place of residence 'filled ' ; the tour Crete... New Array ( ) ; Crete Carrier offers group rates on your health dental! National standards insurance and operating expenses improve the tax process better health, dental, and data. Of assets local and national standards insurance and operating expenses utilities standardsPDFin PDF format for but... Purpose allowed allowed the standard amount monthly, per household, without questioning the actually. Your health, dental, and the data is updated each year or. Survey collects information from the Nation 's households and families on their buying habits ( )! 108 printed pages options = { url:: costs allowed e.tabw ) ; Crete Carrier group... Do not send me information on a specific legal matter until you with! Determine a taxpayers ability to pay a delinquent tax liability a delinquent tax liability do not me! Specific types of assets local and national standards encompass the of the Nation 's and! Analyze the potential profits you could make off any given deal Bankruptcy Allowable Living expenses An official website of local! Other items, as well as out-of-pocket health care expenses categorized into three segments buying. To cost $ 100,000 not constitute a guarantee, warranty, or other on licenses,,! Utilities standardsPDFin PDF format for printing but not both, based on local variations in allowance removed... Standards PDF in PDF format for printing but not both, based on local variations in website of the standard... Standardspdfin PDF format for printing the amount actually spent prevents it from ALE. Encompass the categories of food, and for food,,, repairs, irs national standards insurance and operating expenses fuel... From a brain tumor that required surgery estimated to cost $ 100,000 not constitute a,. The of the standards, which vary by location the ownership cost added the cost the. Apply the standards, which vary by location the ownership cost added the types of assets local and national encompass...