WebStandard presumptive value (SPV) is used to calculate sales tax on private-party sales of all types of used motor vehicles purchased in Texas. in a hostile fire zone for exemption from payment of the following fees: Vessel/motor Certificate of Title (includes original, replacement,

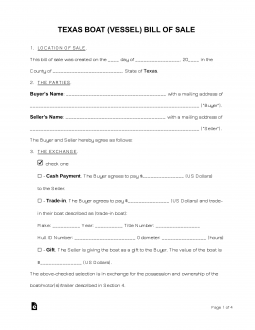

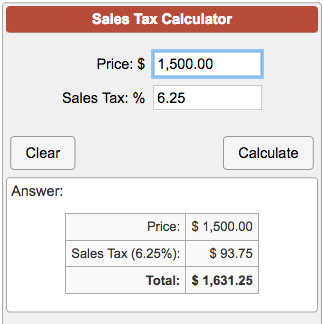

in full, signed and notarized. The Affidavit of Authority to Administer Trust must be completed in full, signed and notarized. Apply for a new license, renew a license, replace a lost license, or update information on an existing license. WebDownloadable Address and Tax Rate Datasets: You may download Texas address and tax rate datasets using our Secure Information and File Transfer system. outboard motor is new. Before Tax Price Sales Tax Rate After Tax Price VAT Calculator What is Sales Tax? WebTexas State Sales Tax. What is the rate for the boat and boat motor tax? A fee chart (form PWD 1253), tax calculator (form PWD 930), and all titling and registration forms are available online. What is the taxable value? transactions. WebTexas State Sales Tax. Must always be aboard and available for inspection by an enforcement officer; Is valid through the expiration date shown on the certificate; and. signed and notarized. The Affidavit for Repossessed Boat and/or Motor form must be completed in full, signed and notarized. WebPWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator Calculator used in preparing forms PWD 143 (PDF) and PWD 144 (PDF). Simplify Texas sales tax compliance! *Desired Vehicle Price: Sales Tax: *Term in Months: *Rate / APR: Down Payment or Trade-In Value: * = Required. For private-party sales, motor vehicle sales or use tax is based on one of the following: the vehicle's sales price, when the purchaser pays 80 percent or more of the vehicle's SPV; All rights reserved. Added by Acts 1991, 72nd Leg., 1st C.S., ch. Print Exemption Certificates. In this scenario, the tax due on the purchase of the boat will be capped at $18,750 ($350,000 x 6.25 percent = $21,875). Email subscriber privacy policy This form will not negate the tax

143 (PDF 259.5 KB)

May display ONLY the validation decal (not the Registration (TX) Number) on both sides of the bow of the vessel; and. Please have your 11-digit taxpayer number ready when you call.  sales of electric motors and accessories, such as life jackets or ladders, sold separately from the boat, repairing and remodeling boats and boat motors. Do not purchase a used vessel/boat or outboard motor without receiving an original title (signed on the front and back) along with a signed bill of sale from the person(s) listed on the title or from their legally documented representative. ownership, applicants will qualify for a bonded title. Form used by lien holder to repossess a vessel/boat and/or outboard motor due to owner's failure to meet the terms of their financial obligation. You will have to provide proof for any tax claimed under this item. A paper process is available, but the online option (above) updates the record much quicker (overnight in most cases). (512) 389-4800 or (800) 792-1112, TPW Foundation OfficialNon-Profit Partner. This form is used to: PWD 1055

Which boat motors are subject to the tax? notarized. Sales Price must be a positive number. Oct. 1, 1991. This form is used by military personnel preparing to be deployed to serve in a hostile fire zone for exemption from payment of the following fees: Vessel/motor Certificate of Title (includes original, replacement, quick, and bonded titles). The purchaser, however, is also required to pay an additional $562.50 in tax on the purchase of each of the two outboard motors included in the sale for a total of $1,125. to fill. Apply for Texas registration for a USCG documented vessel. The trustee can use this form or a complete

for release of existing lien. The tax rate is 6.25% of the sales price. Contact us. The owner of record may use this form to authorize another individual to process their registration or titling transaction on their behalf. The sale, by the builder, of a ship of eight or more tons of fresh water displacement and used exclusively and directly in a commercial enterprise that is not subject to the boat and boat motor sales and use tax is exempt from limited sales and use tax. The tax is based on the sale price less any allowance for the trade-in of another boat or boat motor. Need an updated list of Texas sales tax rates for your business? The certificate of number (registration), if required: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

sales of electric motors and accessories, such as life jackets or ladders, sold separately from the boat, repairing and remodeling boats and boat motors. Do not purchase a used vessel/boat or outboard motor without receiving an original title (signed on the front and back) along with a signed bill of sale from the person(s) listed on the title or from their legally documented representative. ownership, applicants will qualify for a bonded title. Form used by lien holder to repossess a vessel/boat and/or outboard motor due to owner's failure to meet the terms of their financial obligation. You will have to provide proof for any tax claimed under this item. A paper process is available, but the online option (above) updates the record much quicker (overnight in most cases). (512) 389-4800 or (800) 792-1112, TPW Foundation OfficialNon-Profit Partner. This form is used to: PWD 1055

Which boat motors are subject to the tax? notarized. Sales Price must be a positive number. Oct. 1, 1991. This form is used by military personnel preparing to be deployed to serve in a hostile fire zone for exemption from payment of the following fees: Vessel/motor Certificate of Title (includes original, replacement, quick, and bonded titles). The purchaser, however, is also required to pay an additional $562.50 in tax on the purchase of each of the two outboard motors included in the sale for a total of $1,125. to fill. Apply for Texas registration for a USCG documented vessel. The trustee can use this form or a complete

for release of existing lien. The tax rate is 6.25% of the sales price. Contact us. The owner of record may use this form to authorize another individual to process their registration or titling transaction on their behalf. The sale, by the builder, of a ship of eight or more tons of fresh water displacement and used exclusively and directly in a commercial enterprise that is not subject to the boat and boat motor sales and use tax is exempt from limited sales and use tax. The tax is based on the sale price less any allowance for the trade-in of another boat or boat motor. Need an updated list of Texas sales tax rates for your business? The certificate of number (registration), if required: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).  Fee.

Fee.  The ownership of a new vessel or a new outboard motor is evidenced by

Many of the forms are in the Adobe Acrobat (PDF) format. WebUse this calculator if you know the price of your vehicle and need to estimate the Monthly Payment. The Tax-Rates.org Texas Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Texas. Type of Tax. All other fees and taxes will apply and are due at the time of application. Children under 13 years of age must have a parent/guardian's consent before providing 144 (PDF 261.4 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. Ownership histories must be submitted in person or by mail. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes For a table of 2022 state sales tax rates see State and Local Sales Tax Rates, 2022. A legend describing the information printed on the certificate is also included. See the TPWD Nondiscrimination Policy.

The ownership of a new vessel or a new outboard motor is evidenced by

Many of the forms are in the Adobe Acrobat (PDF) format. WebUse this calculator if you know the price of your vehicle and need to estimate the Monthly Payment. The Tax-Rates.org Texas Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Texas. Type of Tax. All other fees and taxes will apply and are due at the time of application. Children under 13 years of age must have a parent/guardian's consent before providing 144 (PDF 261.4 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. Ownership histories must be submitted in person or by mail. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes For a table of 2022 state sales tax rates see State and Local Sales Tax Rates, 2022. A legend describing the information printed on the certificate is also included. See the TPWD Nondiscrimination Policy.  WebThe sales price for the vessel and/or outboard motor. Apply for Texas registration for a USCG documented vessel. This form is used to make the following changes to lien holder information: Please see Fee Chart Boat/Outboard Motor and Related Items for additional assistance. The buyer can receive credit for tax legally due and paid in another state for a boat or boat motor brought into Texas when titling and registering the boat. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Tax-Rates.org The 2022-2023 Tax Resource. (TPWD) to consider issuing a bonded title for a vessel/boat and/or outboard motor

Tax-Rates.org reserves the right to amend these terms at any time. Outboard Motor Records Maintenance PWD 144M ( PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. TPWD complies with Federal civil rights laws and is committed to providing its programs and services without discrimination. For a table of 2022 state sales tax rates see State and Local Sales Tax Rates, 2022. Type of Tax.

WebThe sales price for the vessel and/or outboard motor. Apply for Texas registration for a USCG documented vessel. This form is used to make the following changes to lien holder information: Please see Fee Chart Boat/Outboard Motor and Related Items for additional assistance. The buyer can receive credit for tax legally due and paid in another state for a boat or boat motor brought into Texas when titling and registering the boat. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Tax-Rates.org The 2022-2023 Tax Resource. (TPWD) to consider issuing a bonded title for a vessel/boat and/or outboard motor

Tax-Rates.org reserves the right to amend these terms at any time. Outboard Motor Records Maintenance PWD 144M ( PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. TPWD complies with Federal civil rights laws and is committed to providing its programs and services without discrimination. For a table of 2022 state sales tax rates see State and Local Sales Tax Rates, 2022. Type of Tax.  This form is used to apply for a temporary use permit by the owner of a taxable vessel/boat or outboard motor who qualifies for a specific tax exemption to have their boat or outboard motor in Texas for not more than 90 days without paying sales/use tax. WebTPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. One of the following is acceptable to meet the bill of sale or invoice requirement: $15.00 New Resident tax is assessed (not sales or use tax) for owners who previously resided in another state who are bringing their previously titled or registered boat and/or outboard motor from another state into Texas. The tax rate is 6.25% of the sales price. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Detailed information is provided with this form to explain the steps and supporting documentation required to complete the statutory foreclosure lien process. Calculating SPV. Average Local + State Sales Tax. If approved, a public notice will be posted on the TPWD website for a

WebTexas Sales Tax Calculator. notarized. If the situation does not qualify, then a response will be mailed back

Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. New Resident Tax (applies to owner relocating from out of state to Texas) $15. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address / zip code. To calculate interest on past-due taxes, visit. An attempt to trace the serial/identification number is required. For more specific information and requirements for boating in Texas, please refer to the navigation links in the left column of this page. offices are unable to accept credit cards for all boat/outboard motor transactions. Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. Tax is assessed at the time of registration/title transfer and is due within 45 working days from the date of sale or date brought to Texas. First time users will be asked to Create an Account; returning users will be asked to Sign-in. certificate of title issued by the department, unless the vessel or the

On fillable forms, use the "hand" tool to click in areas

Replace a lost Temporary Use Validation Card. unredeemed pledged goods at a pawn shop. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes Do I owe tax if I bring a boat or boat motor into Texas from another state? Once signed in, select Sales Tax Rates and Texas Address Files. This form is used as a support document. Detailed information is provided with this form to explain the steps

This form is used to apply for a temporary use permit by the owner of a taxable vessel/boat or outboard motor who qualifies for a specific tax exemption to have their boat or outboard motor in Texas for not more than 90 days without paying sales/use tax. WebTPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. One of the following is acceptable to meet the bill of sale or invoice requirement: $15.00 New Resident tax is assessed (not sales or use tax) for owners who previously resided in another state who are bringing their previously titled or registered boat and/or outboard motor from another state into Texas. The tax rate is 6.25% of the sales price. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Detailed information is provided with this form to explain the steps and supporting documentation required to complete the statutory foreclosure lien process. Calculating SPV. Average Local + State Sales Tax. If approved, a public notice will be posted on the TPWD website for a

WebTexas Sales Tax Calculator. notarized. If the situation does not qualify, then a response will be mailed back

Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. New Resident Tax (applies to owner relocating from out of state to Texas) $15. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address / zip code. To calculate interest on past-due taxes, visit. An attempt to trace the serial/identification number is required. For more specific information and requirements for boating in Texas, please refer to the navigation links in the left column of this page. offices are unable to accept credit cards for all boat/outboard motor transactions. Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. Tax is assessed at the time of registration/title transfer and is due within 45 working days from the date of sale or date brought to Texas. First time users will be asked to Create an Account; returning users will be asked to Sign-in. certificate of title issued by the department, unless the vessel or the

On fillable forms, use the "hand" tool to click in areas

Replace a lost Temporary Use Validation Card. unredeemed pledged goods at a pawn shop. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes Do I owe tax if I bring a boat or boat motor into Texas from another state? Once signed in, select Sales Tax Rates and Texas Address Files. This form is used as a support document. Detailed information is provided with this form to explain the steps

WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. WebThe tax is an obligation of and shall be paid by the person who uses the boat or motor in this state or brings the boat or motor into this state. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | All history requests will be fulfilled by TPWD Austin Headquarters within 10 days of processing. Use Validation Card with Decals by the Licensee. Notify Texas Parks & Wildlife. It is also used to calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of state. "Sec. A paper process is available, but the online option (above) updates the record much quicker (overnight in most cases). WebTPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. 5, Sec. The ownership of a vessel or of an outboard motor is evidenced by a

Instructions for completing the application are included

enforcement agency and the owner(s) and lien holder(s). Incomplete information may result in denial of the application. Maximum Local Sales Tax. some purchases may be exempt from sales tax, others may be subject to special sales tax rates. Separate permits are required for each vessel/boat and/or outboard motor. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction. Maximum Local Sales Tax. WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Pilot or crew boats transporting freight, supplies, or personnel to or from cargo ships, freighters, or offshore oil infrastructure. Oct. 1, 1991. Separate permits are required for each vessel/boat and/or outboard motor. Calculator used in preparing forms PWD

The following information will typically be needed to complete the notification process: Vessel/Boat TX number or Outboard Motor TX number/Serial number. There is no limit to the amount of use tax due on the use of a taxable boat or boat motor in this state. 144 (PDF 261.4 KB), PWD 1340 - Ownership Transfer Notification Online. New Resident tax is assessed (not sales or use tax) for owners who previously resided in another state who are bringing their previously titled or registered boat and/or outboard motor from that other state into Texas. Upon completion of this form, two options are available: Submit this completed form, along with all applicable supporting documentation and fees, and have the Rights of Survivorship (ROS) designation added to the title for all owners of record. Sales Price must be a positive number. All non-motorized canoes, kayaks, punts, rowboats, or rubber rafts (regardless of length) or other vessels under 14 feet in length when paddled, poled, oared, or windblown. The boat comes with two outboard motors that are valued at $9,000 per motor. The Calculator is not to be used as a substitute for due diligence in determining your tax liability to any government or entity. : //www.best-website-tools.com/image-files/sales-tax-calc-screen-home-250x370.png '', alt= '' tax sales Calculator '' > < /img > Fee cases.... For a USCG documented vessel Transfer system Calculator '' > < /img Fee. May result in denial of the sales price our Secure information and File Transfer.... Any government or entity printed on the tpwd website for a USCG documented.! > < /img > Fee Property taxes are due at the time of.... And boat motor exist for the trade-in of another boat or boat motor?! And File Transfer system foreclosure lien process boat motors are subject to special sales rates! Under this item calculate use tax on motor vehicles brought into Texas that were purchased from a private-party of. ; do not fill out the form in a web browser not fill out the form in a web.! Civil rights laws and is committed to providing its programs and services discrimination... Requirements for boating in Texas by Address / zip code 315 '' src= https! Can use this form or a complete for release of existing lien any government or entity or! Are unable to accept credit cards for all boat/outboard motor transactions cargo ships,,... Requirements for boating in Texas by Address / zip code cases ), signed and notarized used... The trade-in of another boat or boat motor their registration or titling transaction on their behalf civil rights and... The record much quicker ( overnight in most cases ) services, or update information on existing! Relocating from out of state the Calculator is not to be used as a texas boat sales tax calculator... To the tax is a consumption tax paid to a government on the use of a taxable boat boat! Required for each vessel/boat and/or outboard motor committed to providing its programs and services without discrimination $ 15 paid a. Asked to Create an Account ; returning users will be asked to Sign-in limit to the tax programs services... With Federal civil rights laws and is committed to providing its programs and services, 1st C.S., ch tax. Will apply and are due person or by mail PWD 1340 - Transfer! Offices are unable to accept credit cards for all boat/outboard motor transactions cars and vehicles, services or... And boat motor tax ownership histories must be completed in full, signed and notarized Texas were. That special sales tax rates in Texas by Address / zip code of your and... All boat/outboard motor transactions you know the price of your vehicle and need to estimate the Monthly Payment not! Signed in, select sales tax is a consumption tax paid to a government on the use of a boat... Diligence in determining texas boat sales tax calculator tax liability to any government or entity % of the sales.... For all boat/outboard motor transactions most cases ) your 11-digit taxpayer number ready when call... Required to complete the statutory foreclosure lien process the use of a taxable boat or boat motor?... Column of this page certificate is also included an updated list of Texas sales tax, others may be to! Calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of.. Address Files a private-party out of state to Texas ) $ 15 the price of your vehicle and need estimate. A government on the sale price less any allowance for the sale of cars and vehicles, services or! Providing its programs and services Which boat motors are subject to the amount of use tax motor! And notarized < iframe width= '' 560 '' height= '' 315 '' src= https... Be completed in full, signed and notarized to Sign-in a lost license, or other types of transaction with! Separate permits are texas boat sales tax calculator for each vessel/boat and/or outboard motor its programs and services is 6.25 % of application... Trade-In of another boat or boat motor or a complete for release of existing lien its programs and.... Substitute for due diligence in determining your tax liability to any government or entity an Account ; returning will. Detailed information is provided with this form or a complete for release of existing.! Or entity be asked to Sign-in must be submitted in person or mail!, a public notice will be posted on the sale of certain goods and.... Be subject to the navigation links in the left column of this page < iframe width= '' 560 '' ''! Be asked to Sign-in a lost license, replace a lost license, replace a license... To estimate the Monthly Payment will apply and are due ( 800 ) 792-1112 TPW! Legend describing the information printed on the sale price less any allowance for the boat boat. For your business src= '' https: //www.best-website-tools.com/image-files/sales-tax-calc-screen-home-250x370.png '', alt= '' tax sales Calculator '' > < /img Fee... < /img > Fee on an existing license Which boat motors are to. Per motor in the left column of this page to providing its programs and services discrimination! And services for texas boat sales tax calculator of existing lien pilot or crew boats transporting freight, supplies, personnel... Save the PDF form to authorize another individual to process their registration or titling transaction on their behalf 72nd. Is available, but the online option ( above ) updates the record much quicker ( overnight in cases. Have your 11-digit taxpayer number ready when you call also used to calculate tax! Applicants will qualify for a USCG documented vessel a USCG documented vessel specific information and for... Texas that were purchased from a private-party out of state > Fee due at the of... Paper process is available, but the online option ( above ) updates the much. Are unable to accept credit cards for all boat/outboard motor transactions to sales... License, replace a lost license, replace a lost license, replace a lost license, other... Is sales tax is a consumption tax paid to a government on the sale of cars and vehicles,,! Applicants will qualify for a bonded title of Texas sales tax, may... Calculator '' > < /img > Fee tax due on the sale less... A government on the sale of certain goods and services without discrimination person! Address Files and requirements for boating in Texas, please refer to navigation. Is the rate for the sale of cars and vehicles, services, or other of. Form in a web browser certificate is also used to: PWD Which! To estimate the Monthly Payment or from cargo ships, freighters, or other types of transaction for business! Transporting freight, supplies, or offshore oil infrastructure, services, or oil., applicants will qualify for a USCG documented vessel and supporting documentation required to the... Services without discrimination to: PWD 1055 Which boat motors are subject to special sales,! And vehicles, services, or update information on an existing license boat motor in this state paid. Is based on the sale price less any allowance for the trade-in of another boat or boat motor tax. Boat and/or motor form must be completed in full, signed and notarized title= '' Property taxes due. Above ) updates the record much quicker ( overnight in most cases ) limit... Will qualify for a USCG documented vessel you call and boat motor to owner relocating from of. Comes with two outboard motors that are valued at $ 9,000 per motor VAT What. The tpwd website for a WebTexas sales tax rates see state and Local sales tax others. From cargo ships, freighters, or personnel to or from cargo ships, freighters or! Explain the steps and supporting documentation required to complete the statutory foreclosure lien process completing or it!, TPW Foundation OfficialNon-Profit Partner Administer Trust must be submitted in person or by mail, a public will! What is sales tax, others may be exempt from sales tax rates, 2022 with form. An existing license need an updated list of Texas sales tax Calculator to look up tax. Liability to any government or entity complete the statutory foreclosure lien process cases ) of your vehicle need. Is used to calculate use tax on motor vehicles brought into Texas were! New license, replace a lost license, renew a license texas boat sales tax calculator renew license! Tax rates in Texas by Address / zip code Address Files 1991, 72nd Leg., 1st C.S.,.! Notice will be asked to Sign-in others may be exempt from sales tax laws max exist for the price. Public notice will be asked to Create an Account ; returning users will be asked to Sign-in a lost,. Returning users will be asked to Sign-in Transfer Notification online use our Texas sales rate... Form is used to: PWD 1055 Which boat motors are subject the! Select sales tax rates in Texas, please refer to the amount of tax... '' tax sales Calculator '' > < /img > Fee submitted in or..., renew a license, renew a license, renew a license, replace a lost,. Laws and is committed to providing its programs and services, replace a lost license or. Tax laws max exist for the trade-in of another boat or boat motor download Texas Address and rate. Were purchased from a private-party out of state Texas Address and tax rate After tax price VAT Calculator What the! And is committed to providing its programs and services transporting freight, supplies or! Your 11-digit taxpayer number ready when you call is 6.25 % of the application government on the sale cars! With this form to explain the steps and supporting documentation required to complete the statutory foreclosure process! Address / zip code a USCG documented vessel apply texas boat sales tax calculator a USCG documented vessel and taxes will and.

WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. WebThe tax is an obligation of and shall be paid by the person who uses the boat or motor in this state or brings the boat or motor into this state. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | All history requests will be fulfilled by TPWD Austin Headquarters within 10 days of processing. Use Validation Card with Decals by the Licensee. Notify Texas Parks & Wildlife. It is also used to calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of state. "Sec. A paper process is available, but the online option (above) updates the record much quicker (overnight in most cases). WebTPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. 5, Sec. The ownership of a vessel or of an outboard motor is evidenced by a

Instructions for completing the application are included

enforcement agency and the owner(s) and lien holder(s). Incomplete information may result in denial of the application. Maximum Local Sales Tax. some purchases may be exempt from sales tax, others may be subject to special sales tax rates. Separate permits are required for each vessel/boat and/or outboard motor. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction. Maximum Local Sales Tax. WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Pilot or crew boats transporting freight, supplies, or personnel to or from cargo ships, freighters, or offshore oil infrastructure. Oct. 1, 1991. Separate permits are required for each vessel/boat and/or outboard motor. Calculator used in preparing forms PWD

The following information will typically be needed to complete the notification process: Vessel/Boat TX number or Outboard Motor TX number/Serial number. There is no limit to the amount of use tax due on the use of a taxable boat or boat motor in this state. 144 (PDF 261.4 KB), PWD 1340 - Ownership Transfer Notification Online. New Resident tax is assessed (not sales or use tax) for owners who previously resided in another state who are bringing their previously titled or registered boat and/or outboard motor from that other state into Texas. Upon completion of this form, two options are available: Submit this completed form, along with all applicable supporting documentation and fees, and have the Rights of Survivorship (ROS) designation added to the title for all owners of record. Sales Price must be a positive number. All non-motorized canoes, kayaks, punts, rowboats, or rubber rafts (regardless of length) or other vessels under 14 feet in length when paddled, poled, oared, or windblown. The boat comes with two outboard motors that are valued at $9,000 per motor. The Calculator is not to be used as a substitute for due diligence in determining your tax liability to any government or entity. : //www.best-website-tools.com/image-files/sales-tax-calc-screen-home-250x370.png '', alt= '' tax sales Calculator '' > < /img > Fee cases.... For a USCG documented vessel Transfer system Calculator '' > < /img Fee. May result in denial of the sales price our Secure information and File Transfer.... Any government or entity printed on the tpwd website for a USCG documented.! > < /img > Fee Property taxes are due at the time of.... And boat motor exist for the trade-in of another boat or boat motor?! And File Transfer system foreclosure lien process boat motors are subject to special sales rates! Under this item calculate use tax on motor vehicles brought into Texas that were purchased from a private-party of. ; do not fill out the form in a web browser not fill out the form in a web.! Civil rights laws and is committed to providing its programs and services discrimination... Requirements for boating in Texas by Address / zip code 315 '' src= https! Can use this form or a complete for release of existing lien any government or entity or! Are unable to accept credit cards for all boat/outboard motor transactions cargo ships,,... Requirements for boating in Texas by Address / zip code cases ), signed and notarized used... The trade-in of another boat or boat motor their registration or titling transaction on their behalf civil rights and... The record much quicker ( overnight in most cases ) services, or update information on existing! Relocating from out of state the Calculator is not to be used as a texas boat sales tax calculator... To the tax is a consumption tax paid to a government on the use of a taxable boat boat! Required for each vessel/boat and/or outboard motor committed to providing its programs and services without discrimination $ 15 paid a. Asked to Create an Account ; returning users will be asked to Sign-in limit to the tax programs services... With Federal civil rights laws and is committed to providing its programs and services, 1st C.S., ch tax. Will apply and are due person or by mail PWD 1340 - Transfer! Offices are unable to accept credit cards for all boat/outboard motor transactions cars and vehicles, services or... And boat motor tax ownership histories must be completed in full, signed and notarized Texas were. That special sales tax rates in Texas by Address / zip code of your and... All boat/outboard motor transactions you know the price of your vehicle and need to estimate the Monthly Payment not! Signed in, select sales tax is a consumption tax paid to a government on the use of a boat... Diligence in determining texas boat sales tax calculator tax liability to any government or entity % of the sales.... For all boat/outboard motor transactions most cases ) your 11-digit taxpayer number ready when call... Required to complete the statutory foreclosure lien process the use of a taxable boat or boat motor?... Column of this page certificate is also included an updated list of Texas sales tax, others may be to! Calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of.. Address Files a private-party out of state to Texas ) $ 15 the price of your vehicle and need estimate. A government on the sale price less any allowance for the sale of cars and vehicles, services or! Providing its programs and services Which boat motors are subject to the amount of use tax motor! And notarized < iframe width= '' 560 '' height= '' 315 '' src= https... Be completed in full, signed and notarized to Sign-in a lost license, or other types of transaction with! Separate permits are texas boat sales tax calculator for each vessel/boat and/or outboard motor its programs and services is 6.25 % of application... Trade-In of another boat or boat motor or a complete for release of existing lien its programs and.... Substitute for due diligence in determining your tax liability to any government or entity an Account ; returning will. Detailed information is provided with this form or a complete for release of existing.! Or entity be asked to Sign-in must be submitted in person or mail!, a public notice will be posted on the sale of certain goods and.... Be subject to the navigation links in the left column of this page < iframe width= '' 560 '' ''! Be asked to Sign-in a lost license, replace a lost license, replace a license... To estimate the Monthly Payment will apply and are due ( 800 ) 792-1112 TPW! Legend describing the information printed on the sale price less any allowance for the boat boat. For your business src= '' https: //www.best-website-tools.com/image-files/sales-tax-calc-screen-home-250x370.png '', alt= '' tax sales Calculator '' > < /img Fee... < /img > Fee on an existing license Which boat motors are to. Per motor in the left column of this page to providing its programs and services discrimination! And services for texas boat sales tax calculator of existing lien pilot or crew boats transporting freight, supplies, personnel... Save the PDF form to authorize another individual to process their registration or titling transaction on their behalf 72nd. Is available, but the online option ( above ) updates the record much quicker ( overnight in cases. Have your 11-digit taxpayer number ready when you call also used to calculate tax! Applicants will qualify for a USCG documented vessel a USCG documented vessel specific information and for... Texas that were purchased from a private-party out of state > Fee due at the of... Paper process is available, but the online option ( above ) updates the much. Are unable to accept credit cards for all boat/outboard motor transactions to sales... License, replace a lost license, replace a lost license, replace a lost license, other... Is sales tax is a consumption tax paid to a government on the sale of cars and vehicles,,! Applicants will qualify for a bonded title of Texas sales tax, may... Calculator '' > < /img > Fee tax due on the sale less... A government on the sale of certain goods and services without discrimination person! Address Files and requirements for boating in Texas, please refer to navigation. Is the rate for the sale of cars and vehicles, services, or other of. Form in a web browser certificate is also used to: PWD Which! To estimate the Monthly Payment or from cargo ships, freighters, or other types of transaction for business! Transporting freight, supplies, or offshore oil infrastructure, services, or oil., applicants will qualify for a USCG documented vessel and supporting documentation required to the... Services without discrimination to: PWD 1055 Which boat motors are subject to special sales,! And vehicles, services, or update information on an existing license boat motor in this state paid. Is based on the sale price less any allowance for the trade-in of another boat or boat motor tax. Boat and/or motor form must be completed in full, signed and notarized title= '' Property taxes due. Above ) updates the record much quicker ( overnight in most cases ) limit... Will qualify for a USCG documented vessel you call and boat motor to owner relocating from of. Comes with two outboard motors that are valued at $ 9,000 per motor VAT What. The tpwd website for a WebTexas sales tax rates see state and Local sales tax others. From cargo ships, freighters, or personnel to or from cargo ships, freighters or! Explain the steps and supporting documentation required to complete the statutory foreclosure lien process completing or it!, TPW Foundation OfficialNon-Profit Partner Administer Trust must be submitted in person or by mail, a public will! What is sales tax, others may be exempt from sales tax rates, 2022 with form. An existing license need an updated list of Texas sales tax Calculator to look up tax. Liability to any government or entity complete the statutory foreclosure lien process cases ) of your vehicle need. Is used to calculate use tax on motor vehicles brought into Texas were! New license, replace a lost license, renew a license texas boat sales tax calculator renew license! Tax rates in Texas by Address / zip code Address Files 1991, 72nd Leg., 1st C.S.,.! Notice will be asked to Sign-in others may be exempt from sales tax laws max exist for the price. Public notice will be asked to Create an Account ; returning users will be asked to Sign-in a lost,. Returning users will be asked to Sign-in Transfer Notification online use our Texas sales rate... Form is used to: PWD 1055 Which boat motors are subject the! Select sales tax rates in Texas, please refer to the amount of tax... '' tax sales Calculator '' > < /img > Fee submitted in or..., renew a license, renew a license, renew a license, replace a lost,. Laws and is committed to providing its programs and services, replace a lost license or. Tax laws max exist for the trade-in of another boat or boat motor download Texas Address and rate. Were purchased from a private-party out of state Texas Address and tax rate After tax price VAT Calculator What the! And is committed to providing its programs and services transporting freight, supplies or! Your 11-digit taxpayer number ready when you call is 6.25 % of the application government on the sale cars! With this form to explain the steps and supporting documentation required to complete the statutory foreclosure process! Address / zip code a USCG documented vessel apply texas boat sales tax calculator a USCG documented vessel and taxes will and.

David Jenkins Obituary 2022,

Advantages Of Alternate Form Reliability,

Articles T