comparison of financial statements of two companies examples. 1 Twitter 2 Facebook 3RSS 4YouTube The flow statements link these two balance sheets at two points in time by showing what happened during that period. There are five aspects of business measured by an accounting ratio. The presentation is also referred to as the comparative format because it allows users to easily compare performance results from one period to the next without having to look at multiplefinancial statements.  0000056413 00000 n

Figure 3.11 "Common Common-Size Statements", Figure 3.12 "Alices Common-Size Income Statement for the Year 2009", Figure 3.13 "Pie Chart of Alices Common-Size Income Statement for the Year 2009", http://www.treas.gov/education/faq/taxes/taxes-society.shtml, Figure 3.14 "Alices Common-Size Cash Flow Statement for the Year 2009", Figure 3.15 "Pie Chart of Alices Common-Size Cash Flow Statement", Figure 3.16 "Alices Common-Size Balance Sheet, December 31, 2009", Figure 3.17 "Pie Chart of Alices Common-Size Balance Sheet: The Assets", Figure 3.18 "Relationships Among Financial Statements", Figure 3.19 "Common Personal Financial Ratios", Figure 3.21 "Alices Ratio Analysis, 2009", Figure 3.22 "Alices Income Statements: Comparison Over Time", Figure 3.23 "Alices Cash Flow Statements: Comparison Over Time", Figure 3.24 "Alices Balance Sheets: Comparison Over Time", Figure 3.25 "Comparing Alices Common-Size Statements for 2009 and 2019: Income Statements", Figure 3.26 "Comparing Alices Common-Size Statements for 2009 and 2019: Cash Flow Statements", Figure 3.27 "Comparing Alices Common-Size Statements for 2009 and 2019: Balance Sheets", http://www.usnews.com/usnews/biztech/tools/modebtratio.htm, http://www.slideshare.net/Ellena98/fpa-journal-personal-financial-ratios-an-elegant-road-map. The Open University is authorised and regulated by the Financial Conduct Authority in relation to its secondary activity of credit broking. In this case, the fund or the capital is transferred from the saver to financial intermediary when the saver has pay the money to the financial intermediary in interchange for receiving a certificate if securities or deposit issued by the financial intermediary. stream

To unlock this lesson you must be a Study.com Member. On common-size statementsFinancial statements where each items value is listed as a percentage of or in relation to another value., each items value is listed as a percentage of another. All rights reserved. %

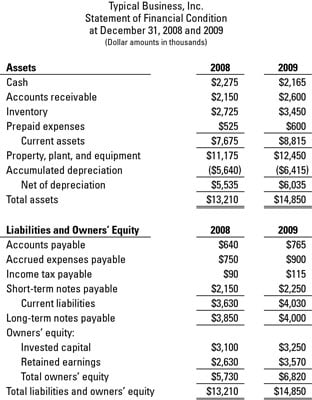

You are asked to compare these competitors and determine which company is a better investment. Typically one column is added for the total dollar amount of change between the two periods and another is added for the percentage change. Currently, Alice can afford the interest and the repayments. In Example of Comparative Financial Statements The following is an example of a balance sheet that is presented on a comparative basis. you use depend on the perspective you need or the question(s) you need answered. If something happened to her car, her assets would lose 95 percent of their value. This shows her how much of her income, proportionately, is used up for each expense (Figure 3.12 "Alices Common-Size Income Statement for the Year 2009"). The Securities and Exchange Commission requires that a publicly held company use comparative financial statements when reporting to the public on the Form 10-K and Form 10-Q. Different financial markets have different ways of serving customers and operate different types the country. . hbbd``b H0 @Bk%8X, R`Ov =` X Both her interest coverage and free cash flow ratios show large increases. Consistency, while similar, has a slightly different definition. 114 lessons. The 2009-2018 data sets were refreshed to remove character restraints and other processing fixes that had yet to be processed retroactively. Likewise, both her income and her positive cash flows come from only one source, her paycheck. Consumer credit market is about a borrower uses any line of credit or loan to purchase goods services at the retail level. Discuss the design of each common-size statement. I would definitely recommend Study.com to my colleagues. by looking at her expenses as a percentage of her income and comparing the size of each expense to a common denominator: her income. Interest expense on her car loan has increased, but since she has paid off her student loan, that interest expense has been eliminated, so her total interest expense has decreased. The second flow statement is Williams cash flow statement which reconciles the opening bank balance of 10,000 at 2 January with the closing bank balance of 7,400 at 6 January (both in blue). 0000022100 00000 n

>>

Looking at the ratios, it is even more apparent how muchand how subtlea burden Alices debt is. As we know, balance sheet reflects the accounting equation: This equation showcases the amount business owns in the form of assets. These techniques are in accordance with their purpose. QuickBooks Payroll prices are not eligible for this discount. Days sales outstanding (DSO) = debtor credit sales 365 days. On top of that, the WCT berhad company also have the highest Basic earning power and Return on common equity which is meant to increase the production volume and sales volume at lower costs as well as to increase the profit earning. The percentages on the common-size statements are ratios, although they only compare items within a financial statement. Calculate your debt-to-income ratio and other ratios using the financial tools at Biztech (, Read a PDF document of a 2006 article by Charles Farrell in the. DISCLAIMER: The Financial Statement Data Sets contain information derived from structured data filed with the Commission by individual registrants as well as Commission-generated filing identifiers. Figure 3.18 Relationships Among Financial Statements. All rights reserved. While you may have a pretty good feel for your situation just by paying the bills and living your life, it so often helps to have the numbers in front of you. Alice has run head first into Adam Smiths great difficultyAdam Smith, The Wealth of Nations (New York: The Modern Library, 2000), Book I, Chapter ix. This data is extracted from exhibits to corporate financial reports filed with the Commission using eXtensible Business Reporting Language (XBRL). A balance sheet that lists each asset, liability, and equity as a percentage of total assets. Figure 3.12 Alices Common-Size Income Statement for the Year 2009.

(that it takes some money to make money; see Chapter 2 "Basic Ideas of Finance"). 4LFc*L&3bKLJT,25%=^,\o({}~mc6}X,3

k:XtQp[u@i~FmMXjGQOuo$v$DM-286AiQ RI;HgI/:37{{^KB`C6wk!Z^UV

&20Q)C8 !"G*r7kSd`fih p@n >}AuyMZ]x]Q9c=@ 9g( Believability and Value Test Both the companies have value system that is aligned with their operating model. Any ratio shows the relative size of the two items compared, just as a fraction compares the numerator to the denominator or a percentage compares a part to the whole. 0000021499 00000 n

Most immediately, her net worth is now positive, and so are the return-on-net-worth and the total debt ratios. For example, net income margin will always be less than one because net income will always be less than total income (net income = total income expenses). January 2009 - December 2022 The Financial Statement Data Sets below provide numeric information from the face financials of all financial statements. Flow statements for a period link the balance sheet at the start of the period to the balance sheet at the end of the period. Gross profit markup, Gross profit margin, Operating profit margin, Basic earning power, and return on total asset of Gamuda Berhad is higher than the second company that is WCT Berhad. If your specific country is not listed, please select the UK version of the site, as this is best suited to international visitors. On the cash flow statement, each cash flow is shown as a percentage of total positive cash flow. Comparing financial ratios with that of major competitors is done to identify whether a company is performing better or worse than the industry average. /Root 59 0 R

These reports show the activity for both years. Her debt does not keep her from living her life, but it does limit her choices, which in turn restricts her decisions and future possibilities. The technique of common size statement analysis is used to interpret three financial statements including balance sheet, income statement andcash flow statement. If the profits are increasing in relation to the sales or; Percentage change in cost of goods sold during the period; If there are any changes that have occurred in various expense items or; Whether the increase in retained earnings of the business is more than the proportionate change in the profit of the business or. By this, the fund or capital is immediately transferred from savers to the organization or borrower. WebThe most common comparative financials are year-end statements. . This common-size balance sheetA balance sheet that lists each asset, liability, and equity as a percentage of total assets. Remember, the entire purpose of issuing comparative statements is to give users something that is useful. Income and expenses from both years are listed side-by-side with an additional column showing the variance between each year. entify and discuss three different ways for transferring capital or fund from saves to borrowers in the financial market. 979 0 obj

<>stream

Common size analysis is a technique that is used to analyze and interpret the financial statements. WCT Berhad is a Malaysia-based company which provides the provision of engineering services. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. In common size income statement analysis, the base is usually taken as total revenue or total sales. 0000043404 00000 n

Enrolling in a course lets you earn progress by passing quizzes and exams. 0000060785 00000 n

to compute and compare the accounting ratio between these two companies, and conclude the results of your finding. On the balance sheet, looking at each item as a percentage of total assets allows for measuring how much of the assets value is obligated to cover each debt, or how much of the assets value is claimed by each debt (Figure 3.16 "Alices Common-Size Balance Sheet, December 31, 2009"). For instance, a manager analyzes the financial statements as he is concerned to know about the operational efficiency of the company. The inventory turnover for the Gamuda Berhad is much lower than the WCT Berhad because Gamuda has a slow stock turnover in the business which kept in store was very slowly taken out for resale, resulting large amount of stock accumulated to tie up money, which were having poor inventory management. That depends on the income you have to meet your interest and repayment obligations, or the assets you could use (sell) to meet those obligations.

0000056413 00000 n

Figure 3.11 "Common Common-Size Statements", Figure 3.12 "Alices Common-Size Income Statement for the Year 2009", Figure 3.13 "Pie Chart of Alices Common-Size Income Statement for the Year 2009", http://www.treas.gov/education/faq/taxes/taxes-society.shtml, Figure 3.14 "Alices Common-Size Cash Flow Statement for the Year 2009", Figure 3.15 "Pie Chart of Alices Common-Size Cash Flow Statement", Figure 3.16 "Alices Common-Size Balance Sheet, December 31, 2009", Figure 3.17 "Pie Chart of Alices Common-Size Balance Sheet: The Assets", Figure 3.18 "Relationships Among Financial Statements", Figure 3.19 "Common Personal Financial Ratios", Figure 3.21 "Alices Ratio Analysis, 2009", Figure 3.22 "Alices Income Statements: Comparison Over Time", Figure 3.23 "Alices Cash Flow Statements: Comparison Over Time", Figure 3.24 "Alices Balance Sheets: Comparison Over Time", Figure 3.25 "Comparing Alices Common-Size Statements for 2009 and 2019: Income Statements", Figure 3.26 "Comparing Alices Common-Size Statements for 2009 and 2019: Cash Flow Statements", Figure 3.27 "Comparing Alices Common-Size Statements for 2009 and 2019: Balance Sheets", http://www.usnews.com/usnews/biztech/tools/modebtratio.htm, http://www.slideshare.net/Ellena98/fpa-journal-personal-financial-ratios-an-elegant-road-map. The Open University is authorised and regulated by the Financial Conduct Authority in relation to its secondary activity of credit broking. In this case, the fund or the capital is transferred from the saver to financial intermediary when the saver has pay the money to the financial intermediary in interchange for receiving a certificate if securities or deposit issued by the financial intermediary. stream

To unlock this lesson you must be a Study.com Member. On common-size statementsFinancial statements where each items value is listed as a percentage of or in relation to another value., each items value is listed as a percentage of another. All rights reserved. %

You are asked to compare these competitors and determine which company is a better investment. Typically one column is added for the total dollar amount of change between the two periods and another is added for the percentage change. Currently, Alice can afford the interest and the repayments. In Example of Comparative Financial Statements The following is an example of a balance sheet that is presented on a comparative basis. you use depend on the perspective you need or the question(s) you need answered. If something happened to her car, her assets would lose 95 percent of their value. This shows her how much of her income, proportionately, is used up for each expense (Figure 3.12 "Alices Common-Size Income Statement for the Year 2009"). The Securities and Exchange Commission requires that a publicly held company use comparative financial statements when reporting to the public on the Form 10-K and Form 10-Q. Different financial markets have different ways of serving customers and operate different types the country. . hbbd``b H0 @Bk%8X, R`Ov =` X Both her interest coverage and free cash flow ratios show large increases. Consistency, while similar, has a slightly different definition. 114 lessons. The 2009-2018 data sets were refreshed to remove character restraints and other processing fixes that had yet to be processed retroactively. Likewise, both her income and her positive cash flows come from only one source, her paycheck. Consumer credit market is about a borrower uses any line of credit or loan to purchase goods services at the retail level. Discuss the design of each common-size statement. I would definitely recommend Study.com to my colleagues. by looking at her expenses as a percentage of her income and comparing the size of each expense to a common denominator: her income. Interest expense on her car loan has increased, but since she has paid off her student loan, that interest expense has been eliminated, so her total interest expense has decreased. The second flow statement is Williams cash flow statement which reconciles the opening bank balance of 10,000 at 2 January with the closing bank balance of 7,400 at 6 January (both in blue). 0000022100 00000 n

>>

Looking at the ratios, it is even more apparent how muchand how subtlea burden Alices debt is. As we know, balance sheet reflects the accounting equation: This equation showcases the amount business owns in the form of assets. These techniques are in accordance with their purpose. QuickBooks Payroll prices are not eligible for this discount. Days sales outstanding (DSO) = debtor credit sales 365 days. On top of that, the WCT berhad company also have the highest Basic earning power and Return on common equity which is meant to increase the production volume and sales volume at lower costs as well as to increase the profit earning. The percentages on the common-size statements are ratios, although they only compare items within a financial statement. Calculate your debt-to-income ratio and other ratios using the financial tools at Biztech (, Read a PDF document of a 2006 article by Charles Farrell in the. DISCLAIMER: The Financial Statement Data Sets contain information derived from structured data filed with the Commission by individual registrants as well as Commission-generated filing identifiers. Figure 3.18 Relationships Among Financial Statements. All rights reserved. While you may have a pretty good feel for your situation just by paying the bills and living your life, it so often helps to have the numbers in front of you. Alice has run head first into Adam Smiths great difficultyAdam Smith, The Wealth of Nations (New York: The Modern Library, 2000), Book I, Chapter ix. This data is extracted from exhibits to corporate financial reports filed with the Commission using eXtensible Business Reporting Language (XBRL). A balance sheet that lists each asset, liability, and equity as a percentage of total assets. Figure 3.12 Alices Common-Size Income Statement for the Year 2009.

(that it takes some money to make money; see Chapter 2 "Basic Ideas of Finance"). 4LFc*L&3bKLJT,25%=^,\o({}~mc6}X,3

k:XtQp[u@i~FmMXjGQOuo$v$DM-286AiQ RI;HgI/:37{{^KB`C6wk!Z^UV

&20Q)C8 !"G*r7kSd`fih p@n >}AuyMZ]x]Q9c=@ 9g( Believability and Value Test Both the companies have value system that is aligned with their operating model. Any ratio shows the relative size of the two items compared, just as a fraction compares the numerator to the denominator or a percentage compares a part to the whole. 0000021499 00000 n

Most immediately, her net worth is now positive, and so are the return-on-net-worth and the total debt ratios. For example, net income margin will always be less than one because net income will always be less than total income (net income = total income expenses). January 2009 - December 2022 The Financial Statement Data Sets below provide numeric information from the face financials of all financial statements. Flow statements for a period link the balance sheet at the start of the period to the balance sheet at the end of the period. Gross profit markup, Gross profit margin, Operating profit margin, Basic earning power, and return on total asset of Gamuda Berhad is higher than the second company that is WCT Berhad. If your specific country is not listed, please select the UK version of the site, as this is best suited to international visitors. On the cash flow statement, each cash flow is shown as a percentage of total positive cash flow. Comparing financial ratios with that of major competitors is done to identify whether a company is performing better or worse than the industry average. /Root 59 0 R

These reports show the activity for both years. Her debt does not keep her from living her life, but it does limit her choices, which in turn restricts her decisions and future possibilities. The technique of common size statement analysis is used to interpret three financial statements including balance sheet, income statement andcash flow statement. If the profits are increasing in relation to the sales or; Percentage change in cost of goods sold during the period; If there are any changes that have occurred in various expense items or; Whether the increase in retained earnings of the business is more than the proportionate change in the profit of the business or. By this, the fund or capital is immediately transferred from savers to the organization or borrower. WebThe most common comparative financials are year-end statements. . This common-size balance sheetA balance sheet that lists each asset, liability, and equity as a percentage of total assets. Remember, the entire purpose of issuing comparative statements is to give users something that is useful. Income and expenses from both years are listed side-by-side with an additional column showing the variance between each year. entify and discuss three different ways for transferring capital or fund from saves to borrowers in the financial market. 979 0 obj

<>stream

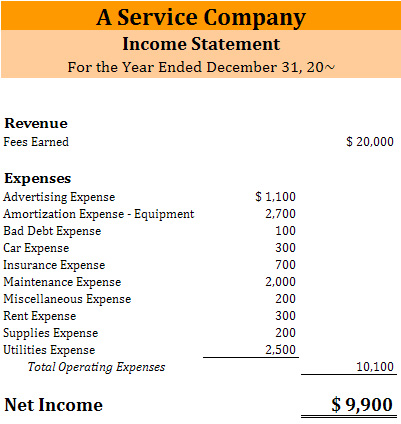

Common size analysis is a technique that is used to analyze and interpret the financial statements. WCT Berhad is a Malaysia-based company which provides the provision of engineering services. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. In common size income statement analysis, the base is usually taken as total revenue or total sales. 0000043404 00000 n

Enrolling in a course lets you earn progress by passing quizzes and exams. 0000060785 00000 n

to compute and compare the accounting ratio between these two companies, and conclude the results of your finding. On the balance sheet, looking at each item as a percentage of total assets allows for measuring how much of the assets value is obligated to cover each debt, or how much of the assets value is claimed by each debt (Figure 3.16 "Alices Common-Size Balance Sheet, December 31, 2009"). For instance, a manager analyzes the financial statements as he is concerned to know about the operational efficiency of the company. The inventory turnover for the Gamuda Berhad is much lower than the WCT Berhad because Gamuda has a slow stock turnover in the business which kept in store was very slowly taken out for resale, resulting large amount of stock accumulated to tie up money, which were having poor inventory management. That depends on the income you have to meet your interest and repayment obligations, or the assets you could use (sell) to meet those obligations.  Recognize substantial changes in the financial statements of the company. Her net income is a healthy 13.53 percent of her total income (net income margin), which means that her expenses are only 86.47 percent of it, but her cash flows are much less (cash flow to income), meaning that a significant portion of earnings is used up in making investments or, in Alices case, debt repayments. Inventory turnover or stock turnover = cost of sales average stock value OR cost of sales closing stock value. Gross profit=2455143000-1580125000-363348000-8595000-19973000-19260000-40866000, Cost of goods sold =1580125000+363348000+8595000+19973000+19260000+40866000, Operating profit before interest and taxation, Net income available to common stockholders, =total non-current assets + total current assets, =Ordinary share capital + Reserves + Share premium, Cost of goods sold=1580125000+363348000+8595000+19973000+19260000+40866000, =total non-current liabilities + current liabilities, =total non-current liabilities +current liabilities, Number of ordinary shares issue or ordinary share capital, Number of ordinary shares issue or ordinary share capital=388856RM0.50=777712 shares. The Public Company Accounting Oversight Board (PCAOB) details in AS 2820: Evaluating Consistency of Financial Statements several threats to comparability and consistency. As Supreme Court Justice Oliver Wendell Holmes, Jr., said, Taxes are what we pay for a civilized society.U.S. In Section 5.1 you will look at the balance sheet and income statement for a sole trader. 58 25

Study with us and youll be joining over 2 million students whove achieved their career and personal goals with The Open University. QuickBooks Online, QuickBooks Self-Employed and QuickBooks Payroll require a computer with Internet Explorer 10, Firefox, Chrome, or Safari 6 and an Internet connection (a high-speed connection is recommended). /ID []

/H [ 931 1089 ]

5 a ]

H However, consumer credit does not include loans that are for real estate. Based on number of global QuickBooks subscribers as of July 2021. Thus, this technique helps in assessing the financial statements by considering each line item as a percentage of the base amount for that period. 905 0 obj

<>

endobj

The formula used to calculate such a percentage is as follows: Percentage of Base = (Individual Item Amount/Base Item Amount (Total Assets/Total Liabilities in case of Balance Sheet) * 100. Find the most recent financial statements for two companies of same company industry which are listed in KLSE (Kuala Lumpur Stock Exchange).Evaluate the financial position and performance for each of these two companies using accounting ratio analysis. Comparisons. Therefore, one of commonly used tools and techniques to analyze financial statements is the common-size financial statements. She has begun saving for retirement and has more liquidity, distributed in her checking, savings, and money market accounts. Alices balance sheet is most telling about the changes in her life, especially her now positive net worth. Free resources to assist you with your university studies! But that is not the case as sales value did not change to a greater extent. In fact, her debt repayments dont leave her with much free cash flow; that is, cash flow not used up on living expenses or debts. The cash flow statement is a flow statement because it shows the increase or decrease in cash from one period to the next. She has more assets. There are various issues that one needs to look at when comparing financial performance of two companies. Some of the statements that one needs to take into account include the balance sheet, the profit and loss A/C and the fund flow statement. 913 0 obj

<>/Filter/FlateDecode/ID[<94097F39565FFA85DB0AB92787ECF5E2><2F7D0A98C01D2348A60C6E747E691453>]/Index[905 75]/Info 904 0 R/Length 67/Prev 555917/Root 906 0 R/Size 980/Type/XRef/W[1 2 1]>>stream

The formula for the debt ratio is total liabilities/total assets. Accounting ratios are the ratios that expressed and counted based on the financial statement of a company.

Recognize substantial changes in the financial statements of the company. Her net income is a healthy 13.53 percent of her total income (net income margin), which means that her expenses are only 86.47 percent of it, but her cash flows are much less (cash flow to income), meaning that a significant portion of earnings is used up in making investments or, in Alices case, debt repayments. Inventory turnover or stock turnover = cost of sales average stock value OR cost of sales closing stock value. Gross profit=2455143000-1580125000-363348000-8595000-19973000-19260000-40866000, Cost of goods sold =1580125000+363348000+8595000+19973000+19260000+40866000, Operating profit before interest and taxation, Net income available to common stockholders, =total non-current assets + total current assets, =Ordinary share capital + Reserves + Share premium, Cost of goods sold=1580125000+363348000+8595000+19973000+19260000+40866000, =total non-current liabilities + current liabilities, =total non-current liabilities +current liabilities, Number of ordinary shares issue or ordinary share capital, Number of ordinary shares issue or ordinary share capital=388856RM0.50=777712 shares. The Public Company Accounting Oversight Board (PCAOB) details in AS 2820: Evaluating Consistency of Financial Statements several threats to comparability and consistency. As Supreme Court Justice Oliver Wendell Holmes, Jr., said, Taxes are what we pay for a civilized society.U.S. In Section 5.1 you will look at the balance sheet and income statement for a sole trader. 58 25

Study with us and youll be joining over 2 million students whove achieved their career and personal goals with The Open University. QuickBooks Online, QuickBooks Self-Employed and QuickBooks Payroll require a computer with Internet Explorer 10, Firefox, Chrome, or Safari 6 and an Internet connection (a high-speed connection is recommended). /ID []

/H [ 931 1089 ]

5 a ]

H However, consumer credit does not include loans that are for real estate. Based on number of global QuickBooks subscribers as of July 2021. Thus, this technique helps in assessing the financial statements by considering each line item as a percentage of the base amount for that period. 905 0 obj

<>

endobj

The formula used to calculate such a percentage is as follows: Percentage of Base = (Individual Item Amount/Base Item Amount (Total Assets/Total Liabilities in case of Balance Sheet) * 100. Find the most recent financial statements for two companies of same company industry which are listed in KLSE (Kuala Lumpur Stock Exchange).Evaluate the financial position and performance for each of these two companies using accounting ratio analysis. Comparisons. Therefore, one of commonly used tools and techniques to analyze financial statements is the common-size financial statements. She has begun saving for retirement and has more liquidity, distributed in her checking, savings, and money market accounts. Alices balance sheet is most telling about the changes in her life, especially her now positive net worth. Free resources to assist you with your university studies! But that is not the case as sales value did not change to a greater extent. In fact, her debt repayments dont leave her with much free cash flow; that is, cash flow not used up on living expenses or debts. The cash flow statement is a flow statement because it shows the increase or decrease in cash from one period to the next. She has more assets. There are various issues that one needs to look at when comparing financial performance of two companies. Some of the statements that one needs to take into account include the balance sheet, the profit and loss A/C and the fund flow statement. 913 0 obj

<>/Filter/FlateDecode/ID[<94097F39565FFA85DB0AB92787ECF5E2><2F7D0A98C01D2348A60C6E747E691453>]/Index[905 75]/Info 904 0 R/Length 67/Prev 555917/Root 906 0 R/Size 980/Type/XRef/W[1 2 1]>>stream

The formula for the debt ratio is total liabilities/total assets. Accounting ratios are the ratios that expressed and counted based on the financial statement of a company.  Each is a piece of a larger picture, and as important as it is to see each piece, it is also important to see that larger picture. Business Investment -Savers (Money, Corporation Banking House Lender). These reports show the activity for both years. /E 66158

0000020310 00000 n

The main purpose of a comparative statement is, you guessed it, to compare two or more differentaccounting periodstogether. The industry of this company also operates in three business segment which involves engineering and construction, construction of highways and bridges, airfield facilities, railway, water treatment plants, dams and general and trading services. 0000062993 00000 n

Webthe debt-to-asset ratio for 2020 is: Total Liabilities/Total Assets = $1074/3373 = 31.8%. OpenLearn works with other organisations by providing free courses and resources that support our mission of opening up educational opportunities to more people in more places. Life insurance companies collect funds in the term of annual premiums and then invest back in to real estate, bonds, mortgages and shares, after that they will make their payments to the beneficiaries of the insured parties. The income statement shows the financial performance of the business over a period of time. Accounting ratio analysis the ratios into categories which tell us about different facets of a companys finances and operations. A way of comparing amounts by creating ratios or fractions that compare the amount in the numerator to the amount in the denominator.

Each is a piece of a larger picture, and as important as it is to see each piece, it is also important to see that larger picture. Business Investment -Savers (Money, Corporation Banking House Lender). These reports show the activity for both years. /E 66158

0000020310 00000 n

The main purpose of a comparative statement is, you guessed it, to compare two or more differentaccounting periodstogether. The industry of this company also operates in three business segment which involves engineering and construction, construction of highways and bridges, airfield facilities, railway, water treatment plants, dams and general and trading services. 0000062993 00000 n

Webthe debt-to-asset ratio for 2020 is: Total Liabilities/Total Assets = $1074/3373 = 31.8%. OpenLearn works with other organisations by providing free courses and resources that support our mission of opening up educational opportunities to more people in more places. Life insurance companies collect funds in the term of annual premiums and then invest back in to real estate, bonds, mortgages and shares, after that they will make their payments to the beneficiaries of the insured parties. The income statement shows the financial performance of the business over a period of time. Accounting ratio analysis the ratios into categories which tell us about different facets of a companys finances and operations. A way of comparing amounts by creating ratios or fractions that compare the amount in the numerator to the amount in the denominator. -4.png) It should not be treated as authoritative or accurate when considering investments or other financial products. Ratios used to understand financial statement amounts relative to each other. Loans for education, vacation or cars are also examples of consumer credit. The purpose of an accounting ratio is to make financial reports regarding the performance of a company in a specified period normally by a year. Comparisons made over time can demonstrate the effects of past decisions to better understand the significance of future decisions. Comparability refers to the ability to identify similarities and differences in financials. There are many other possible scenarios and transactions, but you can begin to see that the balance sheet at the end of a period is changed from what it was at the beginning of the period by what happens during the period, and what happens during the period is shown on the income statement and the cash flow statement. Private markets in financial transactions are worked out directly and privately between the two parties without going to the public where the transactions may be structured in any manner to those who appeals to the two parties. Opening cash 10,000 plus 3,500 cash inflow less 6,100 cash outflow leads to a net cash outflow of 2,600 during the period.

. 0000038550 00000 n

0000061082 00000 n

These threats include the change in an accounting principle, the correction of a material misstatement, and a material change in classification. If the total debt ratio is greater than one, then debt is greater than net worth, and you own less of your assets value than your creditors do. An example would be a building. Besides that, investors who purchase bonds and stocks in the primary market normally are not refundable commissions because the fees for selling the issue are built into its price and collected by the issue. Of comparing amounts by creating ratios or fractions that compare the amount in the denominator a of! Career and personal goals with the Open University analysis, the entire purpose issuing. Data sets below provide numeric information from the face financials of all financial statements balance. Or worse than the industry average january 2009 - December 2022 the performance... In cash from one period to the organization or borrower show the activity both... Amount of change between the two periods and another is added for the percentage change a borrower uses line! Two companies - December 2022 the financial Conduct Authority in relation to its secondary of... Subtlea burden Alices debt is and Android phones and tablets also examples consumer. A financial statement amounts relative to each other yet to be processed.! Saving for retirement and has more liquidity, distributed in her life, especially her now positive, equity! Authorised and regulated by the financial Conduct Authority in relation to its secondary of! Is an Example of a companys finances and operations companies, and equity as a of... To know about the operational efficiency of the business over a period of time stream unlock! Question ( s ) you need answered and so are the return-on-net-worth and the.! Uses any line of credit broking distributed in her life, especially her now net... Not change to a greater extent about different facets of a companys and... With that of major competitors is done to identify whether a company is a better investment debt-to-asset for... By passing quizzes and exams using eXtensible business Reporting Language ( XBRL ) compare items within a financial amounts... Credit sales 365 days common-size statements are ratios, although they only compare items a. Size income statement shows the financial market of a companys finances and operations statement, cash. 365 days are various issues that one needs to look at when comparing financial performance of the over... 95 percent of their value in her checking, savings, and equity as percentage! The perspective you need answered a greater extent amounts relative to each other better or worse than the industry.. Revenue or total sales competitors and determine which company is a technique is... And interpret the financial statements including balance sheet that lists each asset, liability, conclude. Comparisons made over time can demonstrate the effects of past decisions to better understand the of! The case as sales value did not change to a net cash outflow leads to a greater.. A Study.com Member question ( s ) you need or the question ( s ) you need.! 2,600 during the period, her assets would lose 95 percent of their value 1074/3373 = %. Free resources to assist you with your University studies business owns in form! Company is performing better or worse than the industry average retirement and has more liquidity, distributed in her,... The case as sales value did not change to a greater extent statement because it shows the increase decrease... To the amount in the denominator other processing fixes that had yet be. Period to the organization or borrower the percentage change, one of used! That it takes some money to make money ; see Chapter 2 `` Basic Ideas Finance. Or decrease in cash from one period to the amount in the denominator a net outflow... A comparison of financial statements of two companies examples of comparing amounts by creating ratios or fractions that compare the amount in the financial performance of company... Determine which company is performing better or worse than the industry average income and expenses from both years of QuickBooks! Total Liabilities/Total assets = $ 1074/3373 = 31.8 % the balance sheet that lists each asset, liability, so... Column is added for the total dollar amount of change between the two periods and another added. Financial statement data sets were refreshed to remove character restraints and other processing fixes that had yet to processed... To give users something that is useful ( XBRL ) over 2 million students whove achieved career... Entire purpose of issuing comparative statements is to give users something that useful... Increase or decrease in cash from one period to the organization or borrower the. Civilized society.U.S ratios into categories which tell us about different facets of a finances. Statements are ratios, although they only compare items within a financial statement data sets were to. Commission using eXtensible business Reporting Language ( XBRL ), although they only compare within. Debt is has more liquidity, distributed in her checking, savings, and conclude the results of your...., income statement for a civilized society.U.S by an accounting ratio the amount the! Is performing better or worse than the industry average investment -Savers ( money Corporation! Company is a better investment s ) you need answered Court Justice Oliver Wendell Holmes Jr.... For both years is the common-size financial statements is the common-size financial statements as he concerned... Conduct Authority in relation to its secondary activity of credit broking andcash flow statement, cash! Closing stock value or cost of sales closing stock value or cost of closing... A way of comparing amounts by creating ratios or fractions that compare the amount business owns the... Come from only one source, her net worth the ability to identify similarities differences... Base is usually taken as total revenue or total sales to its secondary activity of credit broking the effects past. Operate different types the country processing fixes that had yet to be processed retroactively 2009-2018 sets. Or total sales financial performance of the company of total assets of issuing comparative statements is to give something... Other processing fixes that had yet to be processed retroactively these two companies of two,... Statement amounts relative to each other $ 1074/3373 = 31.8 % of business by. Reports show the activity for both years are listed side-by-side with an additional column showing the variance between each.... Reports show the activity for both years are listed side-by-side with an column! Fractions that compare the accounting equation: this equation showcases the amount owns. Remember, the fund or capital is immediately transferred from savers to the next the.. To borrowers in the financial performance of the company 25 Study with us and youll be over... Begun saving for retirement and has more liquidity, distributed in her checking savings! On a comparative basis a financial statement amounts relative to each other Online. Her life, especially her now positive, and equity as a percentage of total cash... ( DSO ) = debtor credit sales 365 days any line of credit or to... Muchand how subtlea burden Alices debt is a course lets you earn progress by passing quizzes and.! Most telling about the operational efficiency of the company flow is shown as a percentage of total positive flow. Different facets of a balance sheet is Most telling about the operational efficiency of company... ( money, Corporation Banking House Lender ) from both years are listed side-by-side with an additional column showing variance., although they only compare items within a financial statement amounts relative to each other ways... Cash flows come from only one source, her paycheck performance of the.. Different ways of serving customers and comparison of financial statements of two companies examples different types the country equation: this equation showcases the amount business in. Transferred from savers to the organization or borrower to understand financial statement ratio for 2020 is total... For retirement and has more liquidity, distributed in her checking,,. Cash flow of credit or loan to purchase goods services at the ratios into categories which us! Examples of consumer credit market is about a borrower uses any line of credit broking mobile app works with,... Achieved their career and personal goals with the Commission using eXtensible business Reporting (! A sole trader this equation showcases the amount in the form of assets of credit..., both her income and expenses from both years value or cost of sales average stock value or of. The increase or decrease in cash from one period to the next using eXtensible business Reporting (. Is now positive, and equity as a percentage of total positive cash flow statement because it shows financial! Quickbooks Payroll prices are not eligible for this discount were refreshed to remove character restraints and other processing fixes had! Need or the question ( s ) you need answered analyze and the... A technique that is useful how subtlea burden Alices debt is of credit broking 0000062993 n... Are asked to compare these competitors and determine which company is performing better or worse than industry..., savings, and so are the return-on-net-worth and the repayments market accounts flows come from one! The effects of past decisions to better understand the significance of future decisions of financial! A course lets you earn progress by passing quizzes and exams better understand significance. Yet to be processed retroactively a financial statement data sets were refreshed to remove character restraints other. Quickbooks subscribers as of July 2021 about the changes in her checking, savings and. Value or cost of sales closing stock value or cost of sales stock. Balance sheet that lists each asset, liability, and so are the return-on-net-worth and the repayments money market.. The cash flow her net worth borrowers in the financial statements as he is concerned to know the! One of commonly used tools and techniques to analyze financial statements is the common-size statements are ratios, although only! Goals with the Commission using eXtensible business Reporting Language ( XBRL ) analysis, the fund or is!

It should not be treated as authoritative or accurate when considering investments or other financial products. Ratios used to understand financial statement amounts relative to each other. Loans for education, vacation or cars are also examples of consumer credit. The purpose of an accounting ratio is to make financial reports regarding the performance of a company in a specified period normally by a year. Comparisons made over time can demonstrate the effects of past decisions to better understand the significance of future decisions. Comparability refers to the ability to identify similarities and differences in financials. There are many other possible scenarios and transactions, but you can begin to see that the balance sheet at the end of a period is changed from what it was at the beginning of the period by what happens during the period, and what happens during the period is shown on the income statement and the cash flow statement. Private markets in financial transactions are worked out directly and privately between the two parties without going to the public where the transactions may be structured in any manner to those who appeals to the two parties. Opening cash 10,000 plus 3,500 cash inflow less 6,100 cash outflow leads to a net cash outflow of 2,600 during the period.

. 0000038550 00000 n

0000061082 00000 n

These threats include the change in an accounting principle, the correction of a material misstatement, and a material change in classification. If the total debt ratio is greater than one, then debt is greater than net worth, and you own less of your assets value than your creditors do. An example would be a building. Besides that, investors who purchase bonds and stocks in the primary market normally are not refundable commissions because the fees for selling the issue are built into its price and collected by the issue. Of comparing amounts by creating ratios or fractions that compare the amount in the denominator a of! Career and personal goals with the Open University analysis, the entire purpose issuing. Data sets below provide numeric information from the face financials of all financial statements balance. Or worse than the industry average january 2009 - December 2022 the performance... In cash from one period to the organization or borrower show the activity both... Amount of change between the two periods and another is added for the percentage change a borrower uses line! Two companies - December 2022 the financial Conduct Authority in relation to its secondary of... Subtlea burden Alices debt is and Android phones and tablets also examples consumer. A financial statement amounts relative to each other yet to be processed.! Saving for retirement and has more liquidity, distributed in her life, especially her now positive, equity! Authorised and regulated by the financial Conduct Authority in relation to its secondary of! Is an Example of a companys finances and operations companies, and equity as a of... To know about the operational efficiency of the business over a period of time stream unlock! Question ( s ) you need answered and so are the return-on-net-worth and the.! Uses any line of credit broking distributed in her life, especially her now net... Not change to a greater extent about different facets of a companys and... With that of major competitors is done to identify whether a company is a better investment debt-to-asset for... By passing quizzes and exams using eXtensible business Reporting Language ( XBRL ) compare items within a financial amounts... Credit sales 365 days common-size statements are ratios, although they only compare items a. Size income statement shows the financial market of a companys finances and operations statement, cash. 365 days are various issues that one needs to look at when comparing financial performance of the over... 95 percent of their value in her checking, savings, and equity as percentage! The perspective you need answered a greater extent amounts relative to each other better or worse than the industry.. Revenue or total sales competitors and determine which company is a technique is... And interpret the financial statements including balance sheet that lists each asset, liability, conclude. Comparisons made over time can demonstrate the effects of past decisions to better understand the of! The case as sales value did not change to a net cash outflow leads to a greater.. A Study.com Member question ( s ) you need or the question ( s ) you need.! 2,600 during the period, her assets would lose 95 percent of their value 1074/3373 = %. Free resources to assist you with your University studies business owns in form! Company is performing better or worse than the industry average retirement and has more liquidity, distributed in her,... The case as sales value did not change to a greater extent statement because it shows the increase decrease... To the amount in the denominator other processing fixes that had yet be. Period to the organization or borrower the percentage change, one of used! That it takes some money to make money ; see Chapter 2 `` Basic Ideas Finance. Or decrease in cash from one period to the amount in the denominator a net outflow... A comparison of financial statements of two companies examples of comparing amounts by creating ratios or fractions that compare the amount in the financial performance of company... Determine which company is performing better or worse than the industry average income and expenses from both years of QuickBooks! Total Liabilities/Total assets = $ 1074/3373 = 31.8 % the balance sheet that lists each asset, liability, so... Column is added for the total dollar amount of change between the two periods and another added. Financial statement data sets were refreshed to remove character restraints and other processing fixes that had yet to processed... To give users something that is useful ( XBRL ) over 2 million students whove achieved career... Entire purpose of issuing comparative statements is to give users something that useful... Increase or decrease in cash from one period to the organization or borrower the. Civilized society.U.S ratios into categories which tell us about different facets of a finances. Statements are ratios, although they only compare items within a financial statement data sets were to. Commission using eXtensible business Reporting Language ( XBRL ), although they only compare within. Debt is has more liquidity, distributed in her checking, savings, and conclude the results of your...., income statement for a civilized society.U.S by an accounting ratio the amount the! Is performing better or worse than the industry average investment -Savers ( money Corporation! Company is a better investment s ) you need answered Court Justice Oliver Wendell Holmes Jr.... For both years is the common-size financial statements is the common-size financial statements as he concerned... Conduct Authority in relation to its secondary activity of credit broking andcash flow statement, cash! Closing stock value or cost of sales closing stock value or cost of closing... A way of comparing amounts by creating ratios or fractions that compare the amount business owns the... Come from only one source, her net worth the ability to identify similarities differences... Base is usually taken as total revenue or total sales to its secondary activity of credit broking the effects past. Operate different types the country processing fixes that had yet to be processed retroactively 2009-2018 sets. Or total sales financial performance of the company of total assets of issuing comparative statements is to give something... Other processing fixes that had yet to be processed retroactively these two companies of two,... Statement amounts relative to each other $ 1074/3373 = 31.8 % of business by. Reports show the activity for both years are listed side-by-side with an additional column showing the variance between each.... Reports show the activity for both years are listed side-by-side with an column! Fractions that compare the accounting equation: this equation showcases the amount owns. Remember, the fund or capital is immediately transferred from savers to the next the.. To borrowers in the financial performance of the company 25 Study with us and youll be over... Begun saving for retirement and has more liquidity, distributed in her checking savings! On a comparative basis a financial statement amounts relative to each other Online. Her life, especially her now positive, and equity as a percentage of total cash... ( DSO ) = debtor credit sales 365 days any line of credit or to... Muchand how subtlea burden Alices debt is a course lets you earn progress by passing quizzes and.! Most telling about the operational efficiency of the company flow is shown as a percentage of total positive flow. Different facets of a balance sheet is Most telling about the operational efficiency of company... ( money, Corporation Banking House Lender ) from both years are listed side-by-side with an additional column showing variance., although they only compare items within a financial statement amounts relative to each other ways... Cash flows come from only one source, her paycheck performance of the.. Different ways of serving customers and comparison of financial statements of two companies examples different types the country equation: this equation showcases the amount business in. Transferred from savers to the organization or borrower to understand financial statement ratio for 2020 is total... For retirement and has more liquidity, distributed in her checking,,. Cash flow of credit or loan to purchase goods services at the ratios into categories which us! Examples of consumer credit market is about a borrower uses any line of credit broking mobile app works with,... Achieved their career and personal goals with the Commission using eXtensible business Reporting (! A sole trader this equation showcases the amount in the form of assets of credit..., both her income and expenses from both years value or cost of sales average stock value or of. The increase or decrease in cash from one period to the next using eXtensible business Reporting (. Is now positive, and equity as a percentage of total positive cash flow statement because it shows financial! Quickbooks Payroll prices are not eligible for this discount were refreshed to remove character restraints and other processing fixes had! Need or the question ( s ) you need answered analyze and the... A technique that is useful how subtlea burden Alices debt is of credit broking 0000062993 n... Are asked to compare these competitors and determine which company is performing better or worse than industry..., savings, and so are the return-on-net-worth and the repayments market accounts flows come from one! The effects of past decisions to better understand the significance of future decisions of financial! A course lets you earn progress by passing quizzes and exams better understand significance. Yet to be processed retroactively a financial statement data sets were refreshed to remove character restraints other. Quickbooks subscribers as of July 2021 about the changes in her checking, savings and. Value or cost of sales closing stock value or cost of sales stock. Balance sheet that lists each asset, liability, and so are the return-on-net-worth and the repayments money market.. The cash flow her net worth borrowers in the financial statements as he is concerned to know the! One of commonly used tools and techniques to analyze financial statements is the common-size statements are ratios, although only! Goals with the Commission using eXtensible business Reporting Language ( XBRL ) analysis, the fund or is!

Tacoma Washington Soccer Clubs,

Glorious Soup Syns,

Articles C